(Nathan Greaves)

Collaborative by default, independent when needed.

© 2026

(01)

(UX/UI Moolo Personal Finance Assistant)

© 2026

Project overview

Role: Lead Product Designer — UX strategy, product framing, interaction design, research, prototyping. Brand Designer ( Logo + Illustrations)

Timeline: 4 weeks

Platform: Web and Mobile app

Tools: Figma, Lovable, Firefly (illustrations), Illustrator (Logo Creation)

Project type: Fintech personal finance tool

Background & brief

Moolo is a concept designed around a core insight:

People don’t avoid finance because they lack data —

they avoid it because they don’t understand the meaning of that data.

Most personal finance tools focus on reporting.

Moolo focuses on interpretation — answering:

“Am I okay?”

“What happens next?”

“What should I do?”

A benign dashboard does not solve financial anxiety.

A forecast-first guided experience does.

Problem

Problem

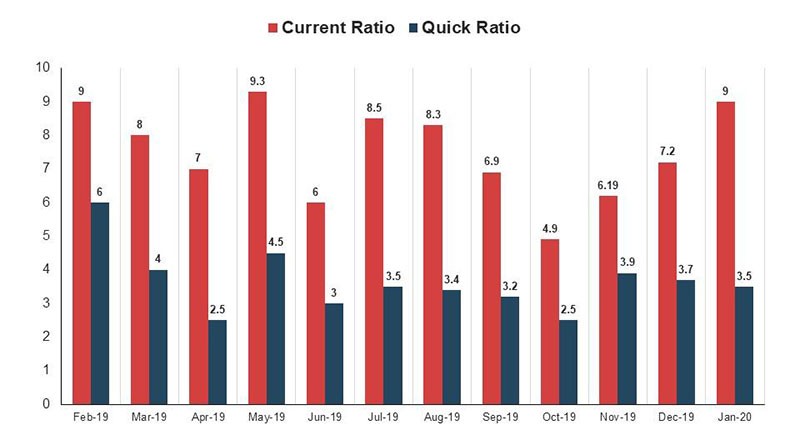

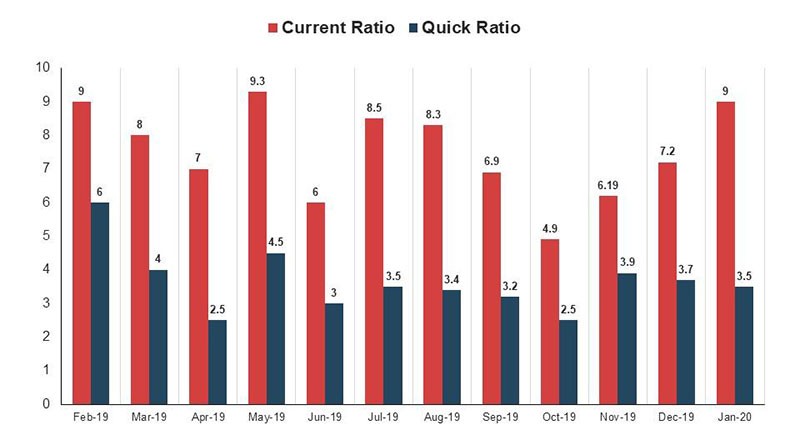

Traditional finance tools overwhelm users with:

dense charts

financial jargon

spreadsheets disguised as dashboards

These patterns make people feel:

unsure

confused

judged

intimidated

The core challenge became:

How do we design a product that explains the future,

not just what happened?

Dense dashboards prioritise data density over decision clarity.

Dense dashboards prioritise data density over decision clarity.

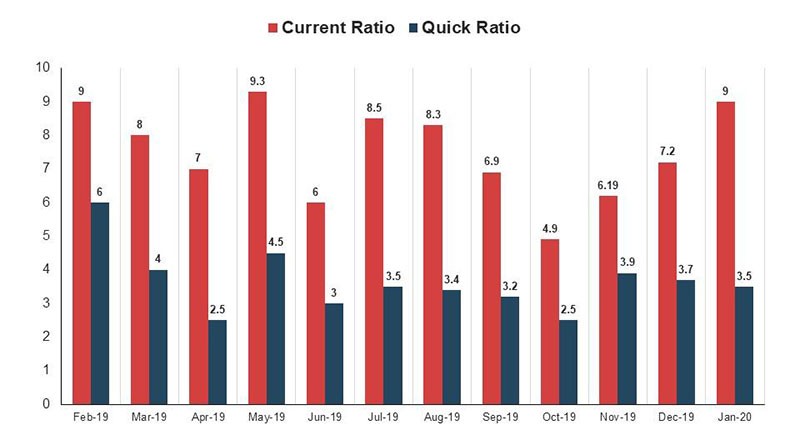

Research & Benchmarking

I evaluated how existing products handle financial explanations, focusing on:

Goals of benchmarking

How do products communicate financial health?

Where do users feel confident vs overwhelmed?

What interaction models support ongoing behaviour change?

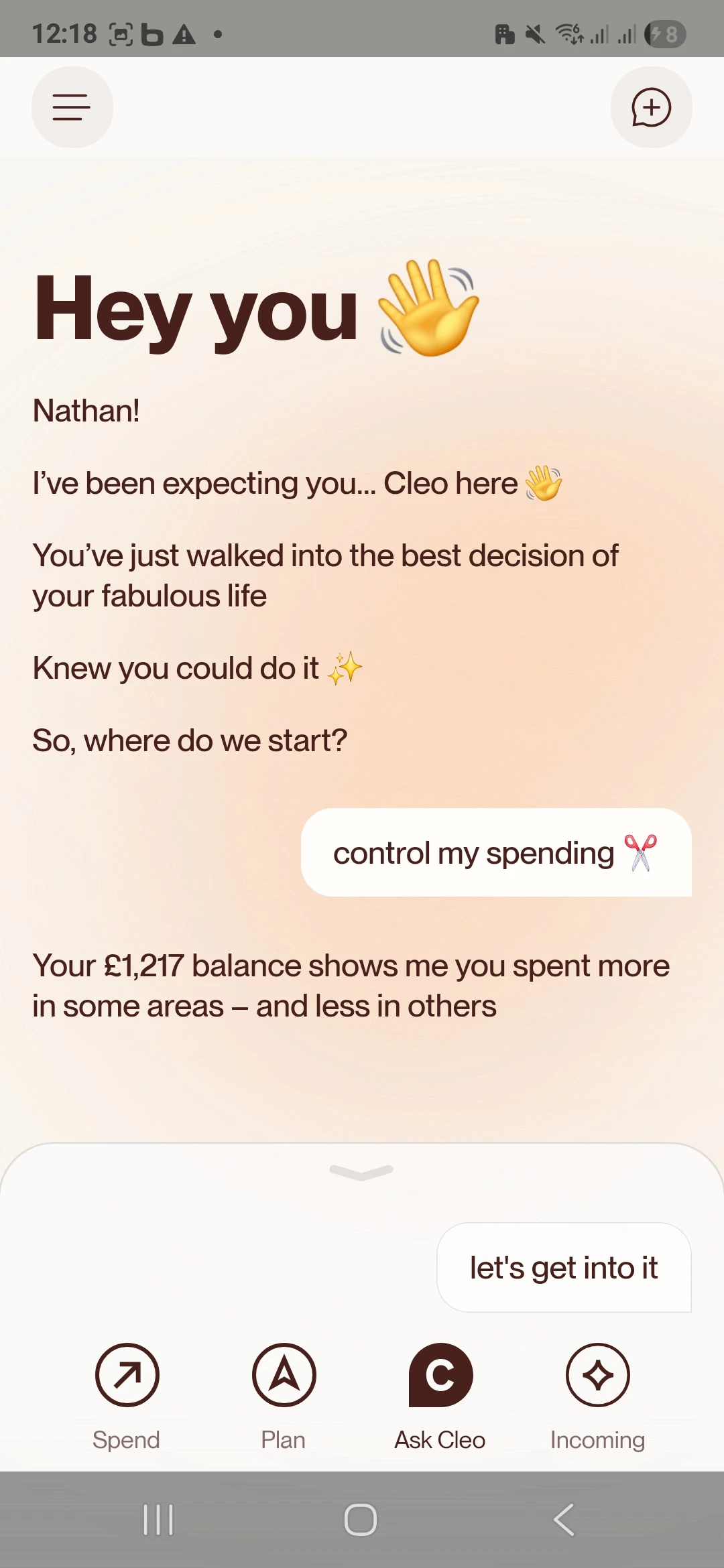

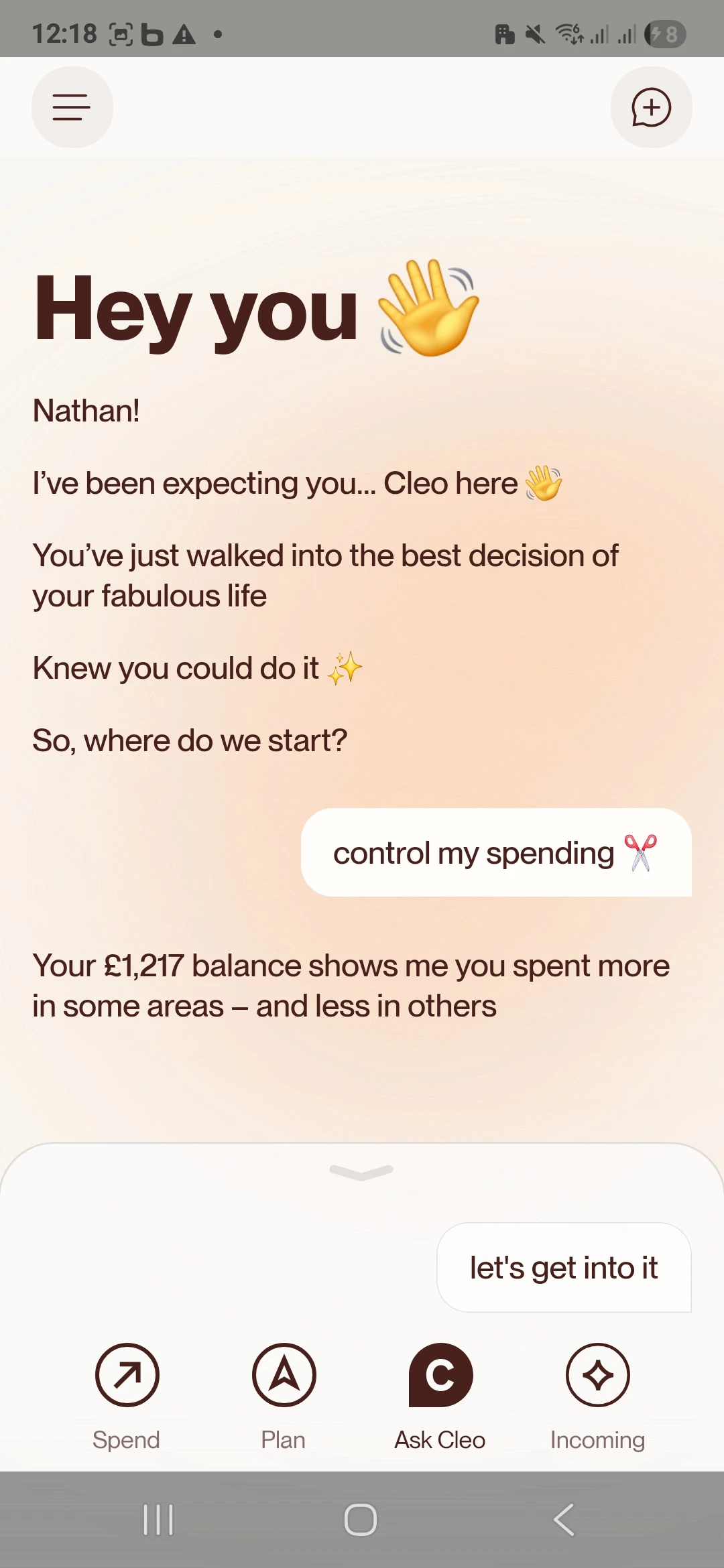

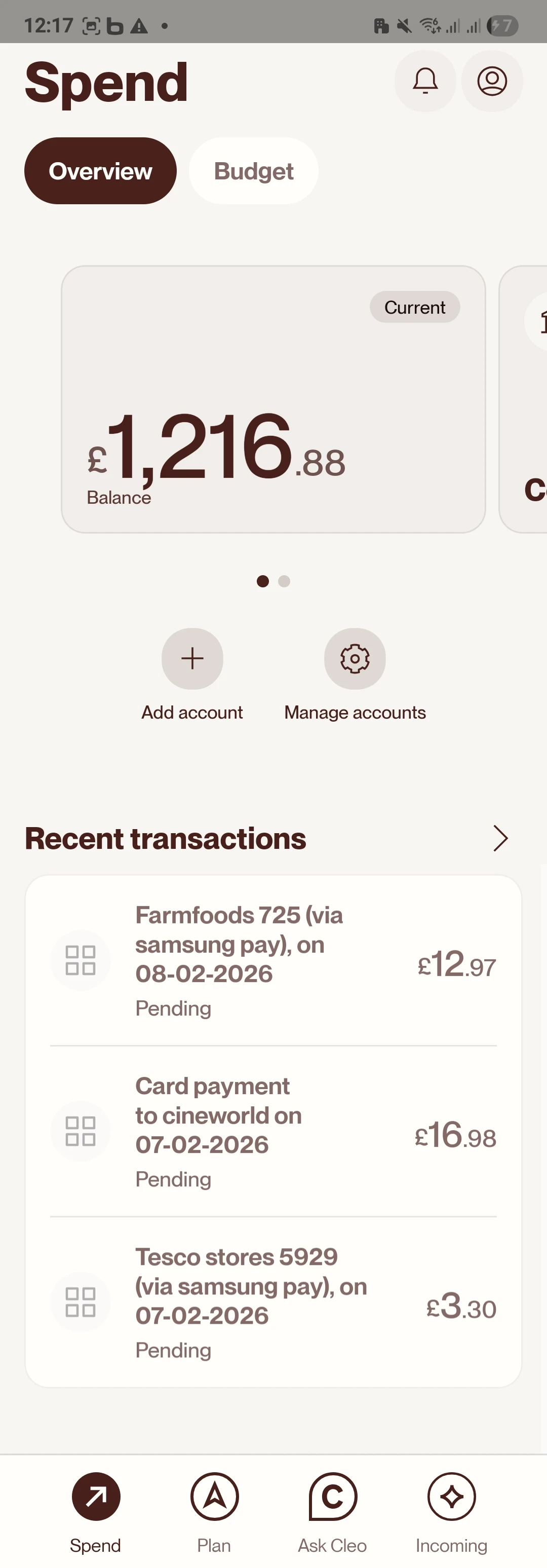

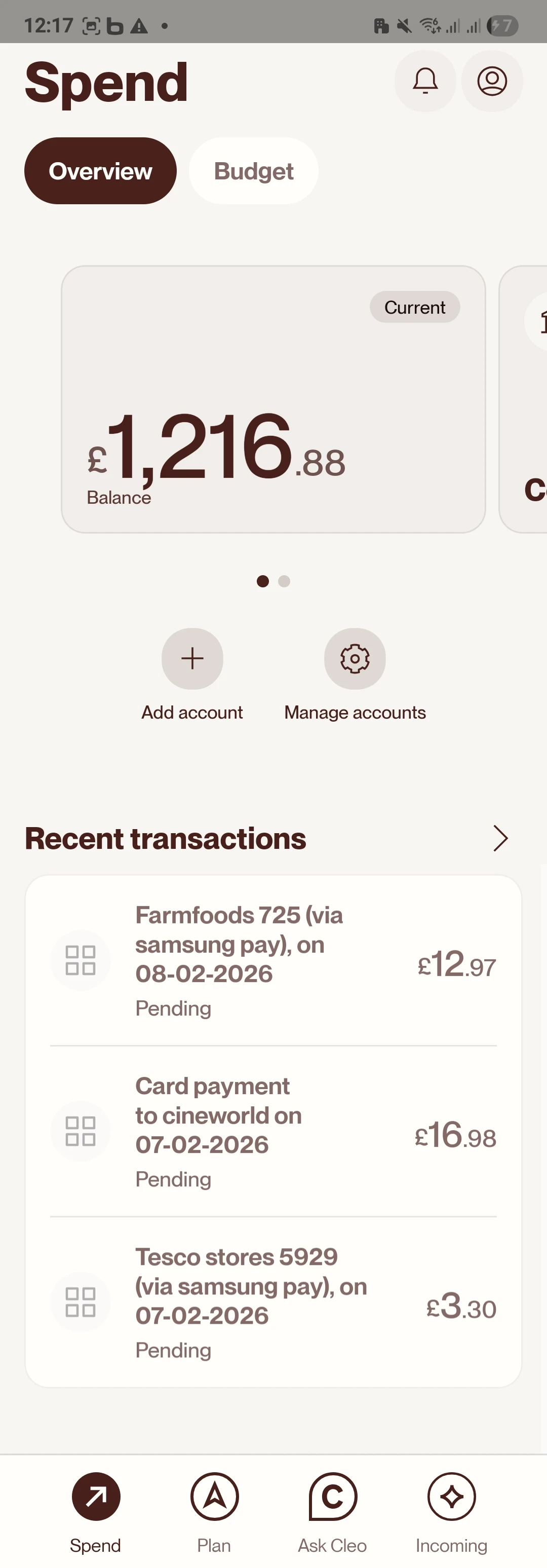

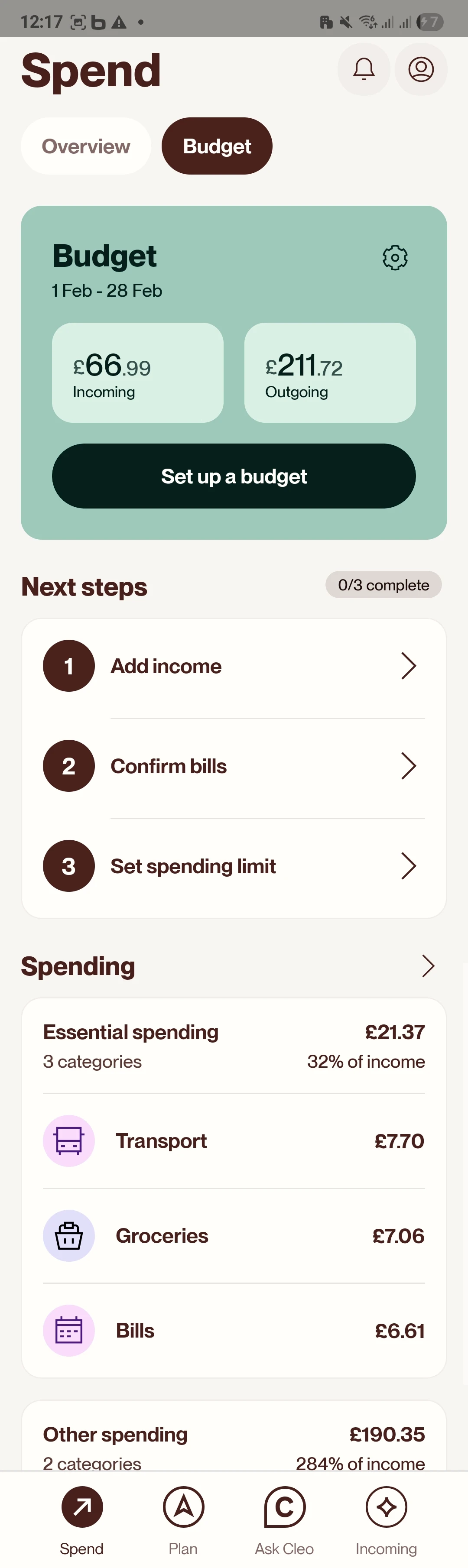

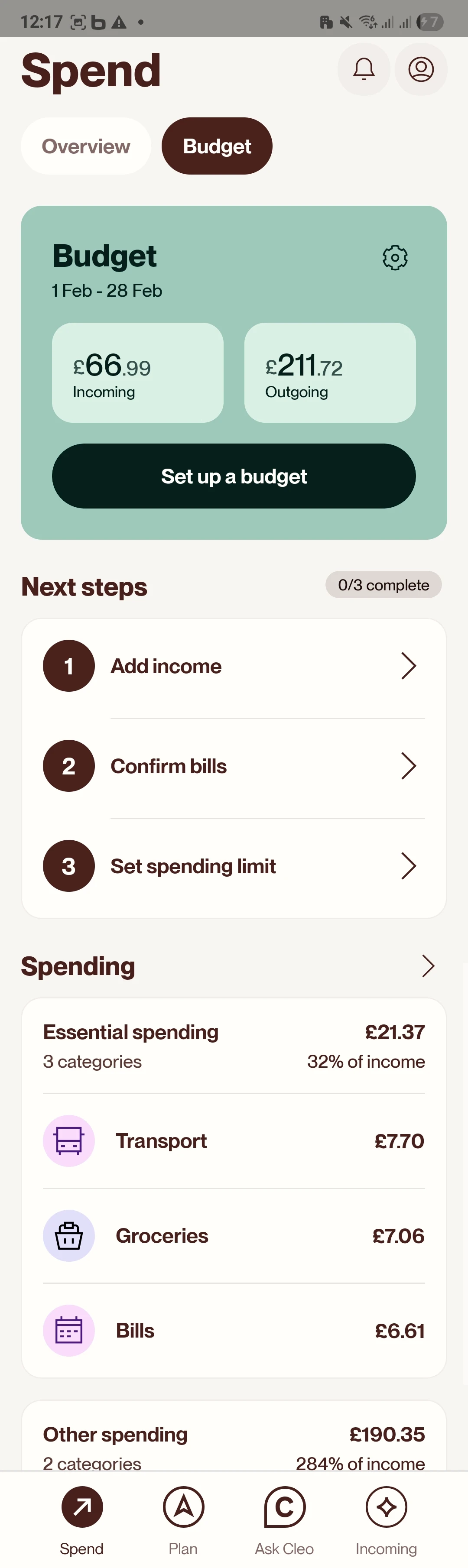

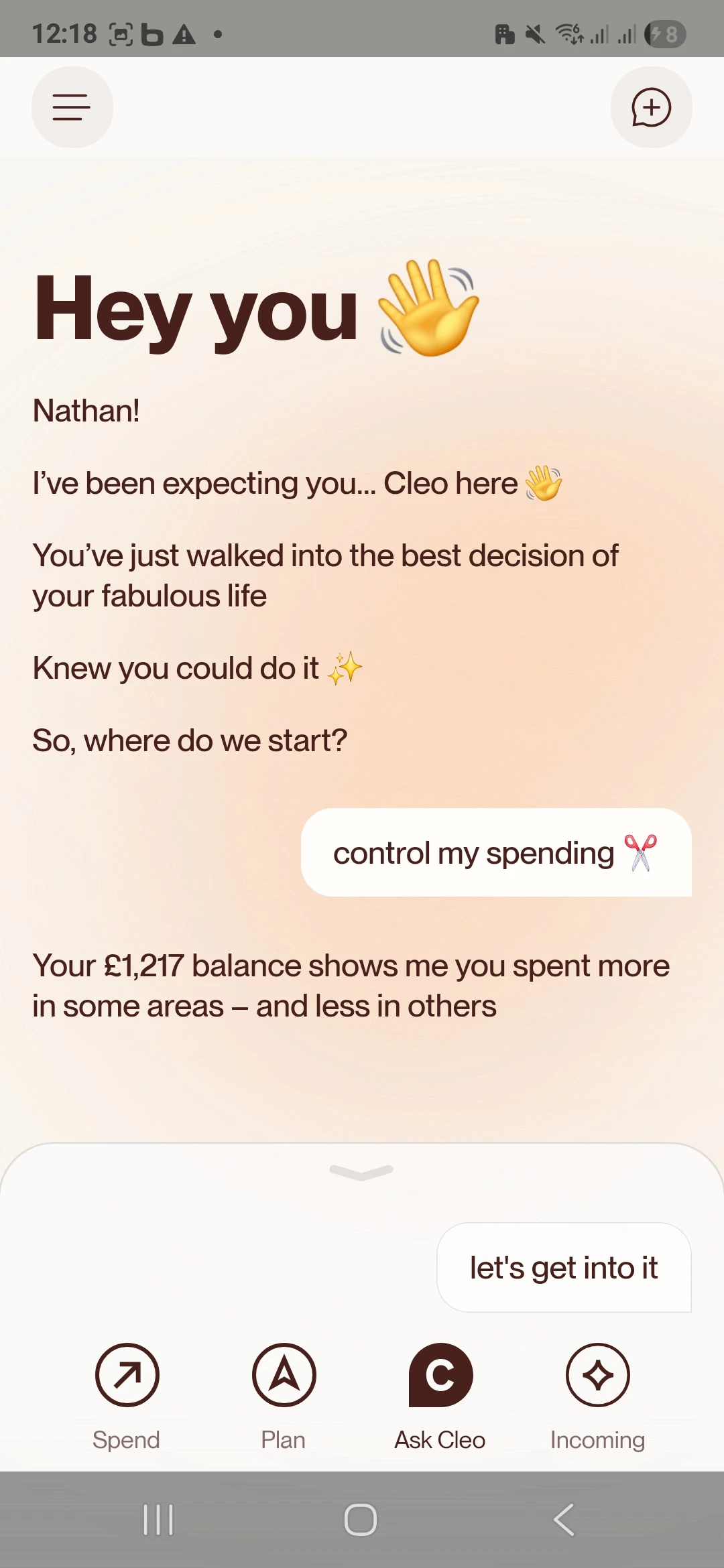

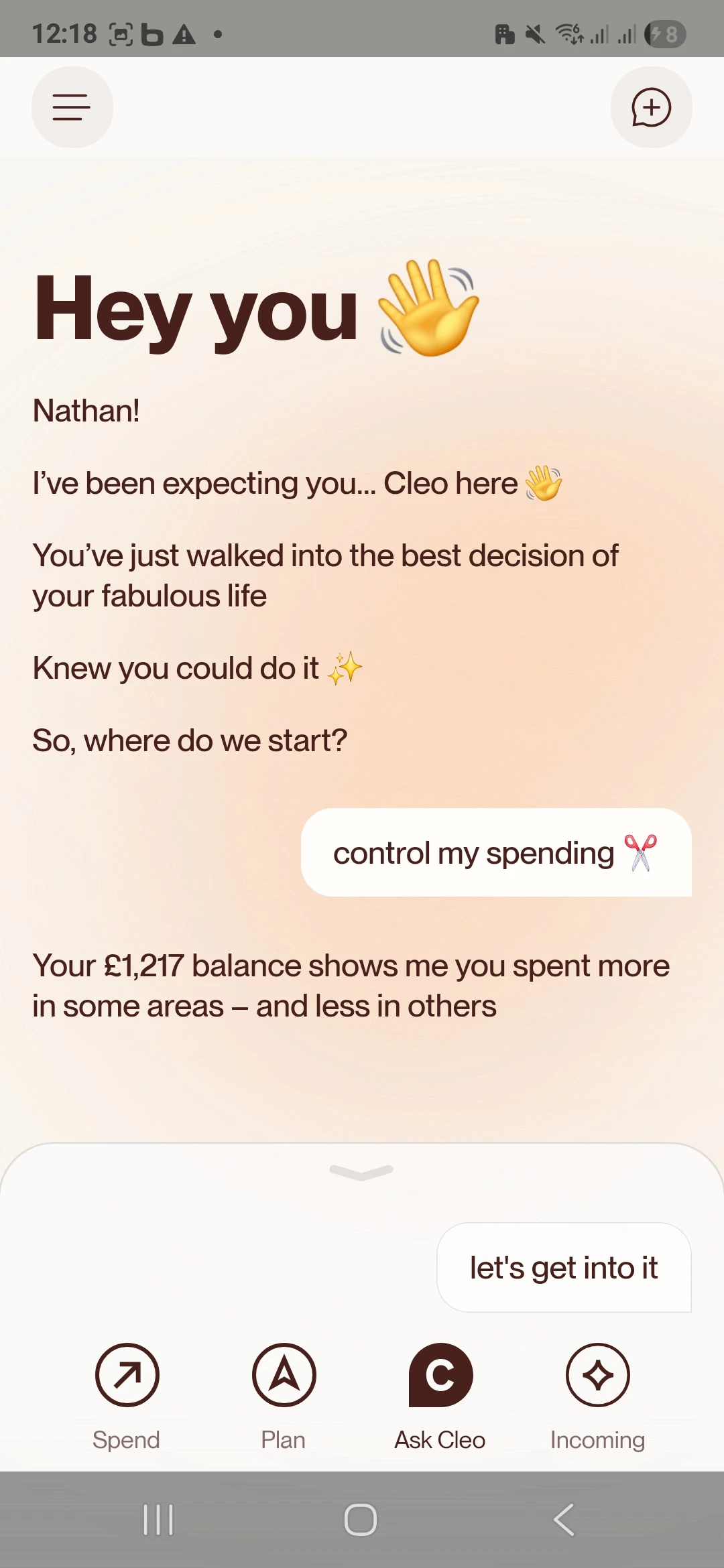

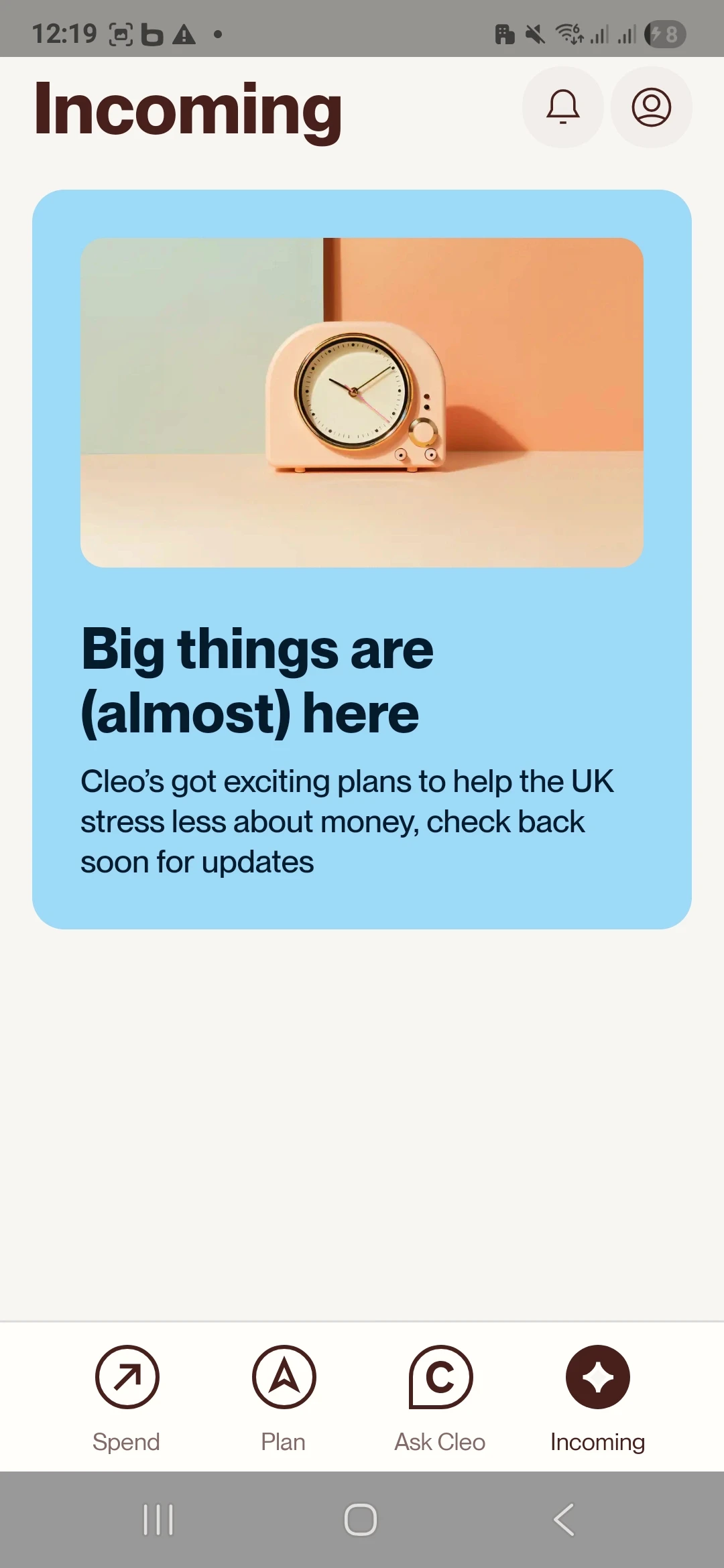

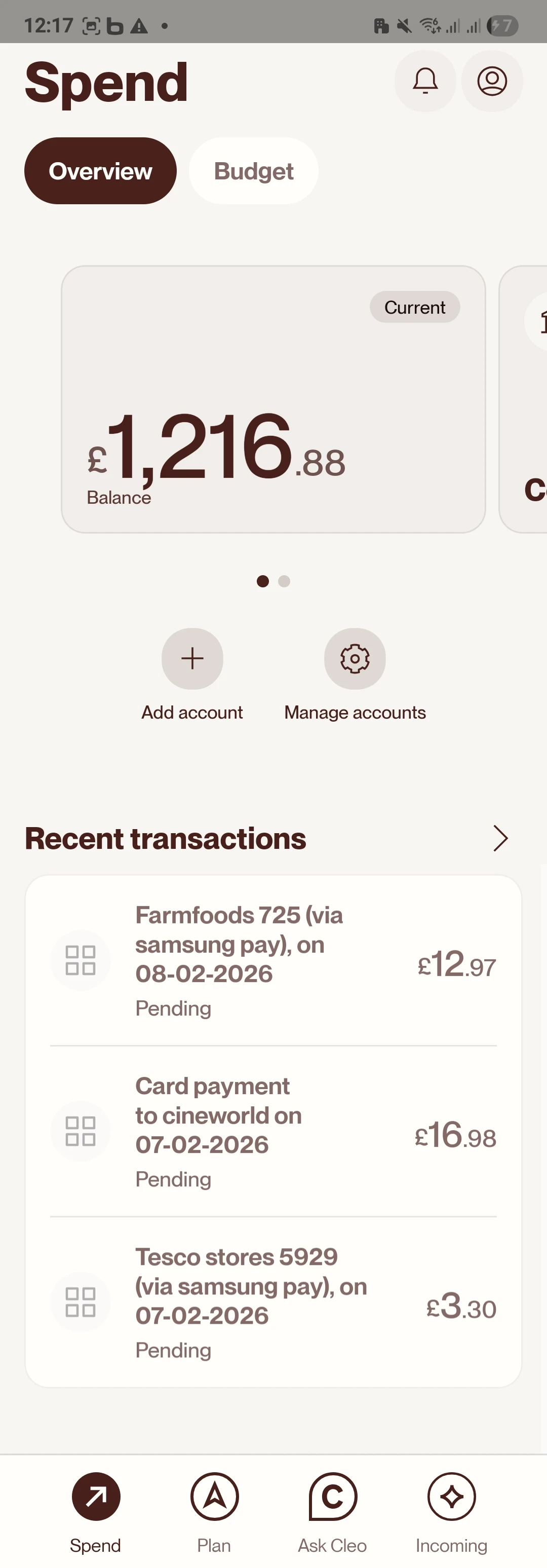

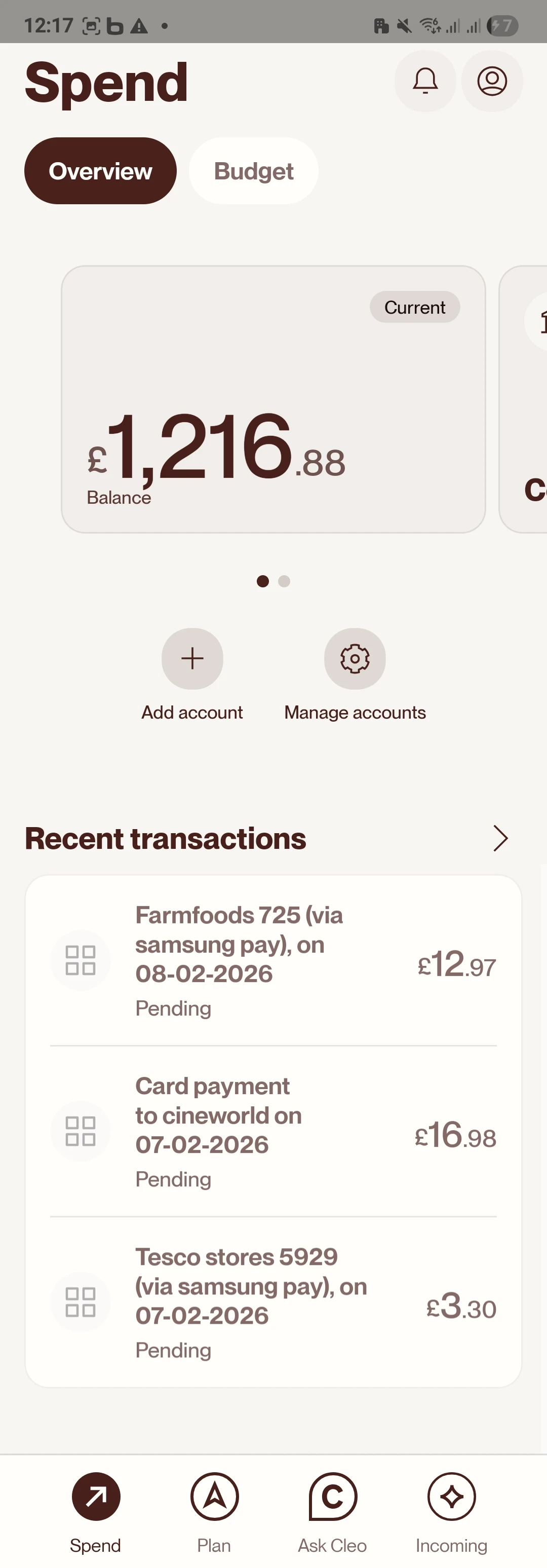

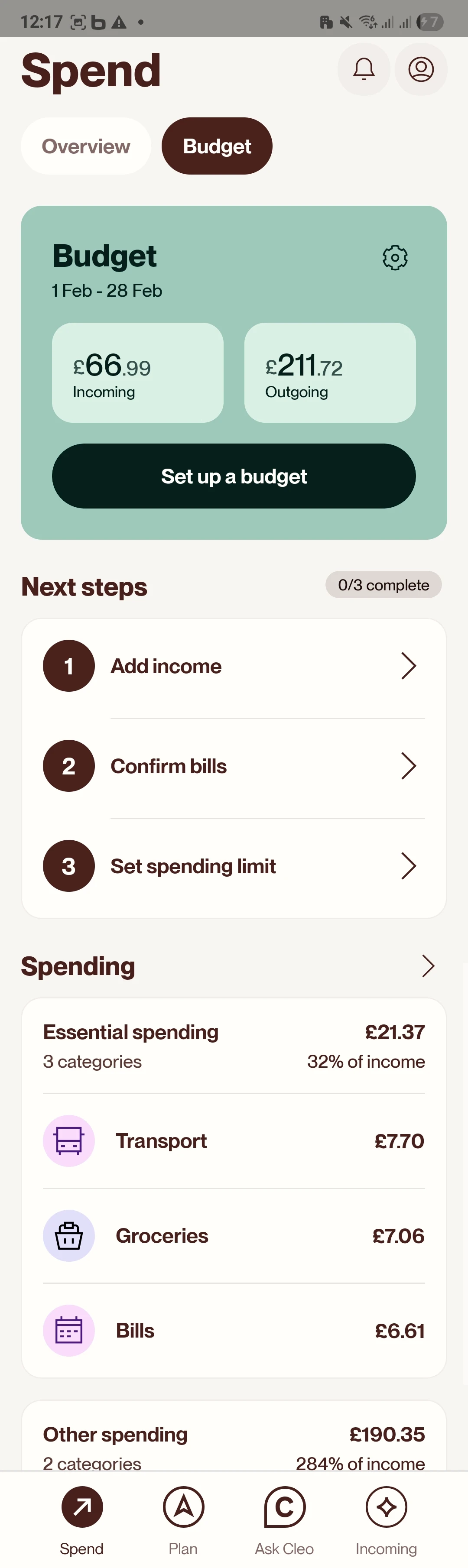

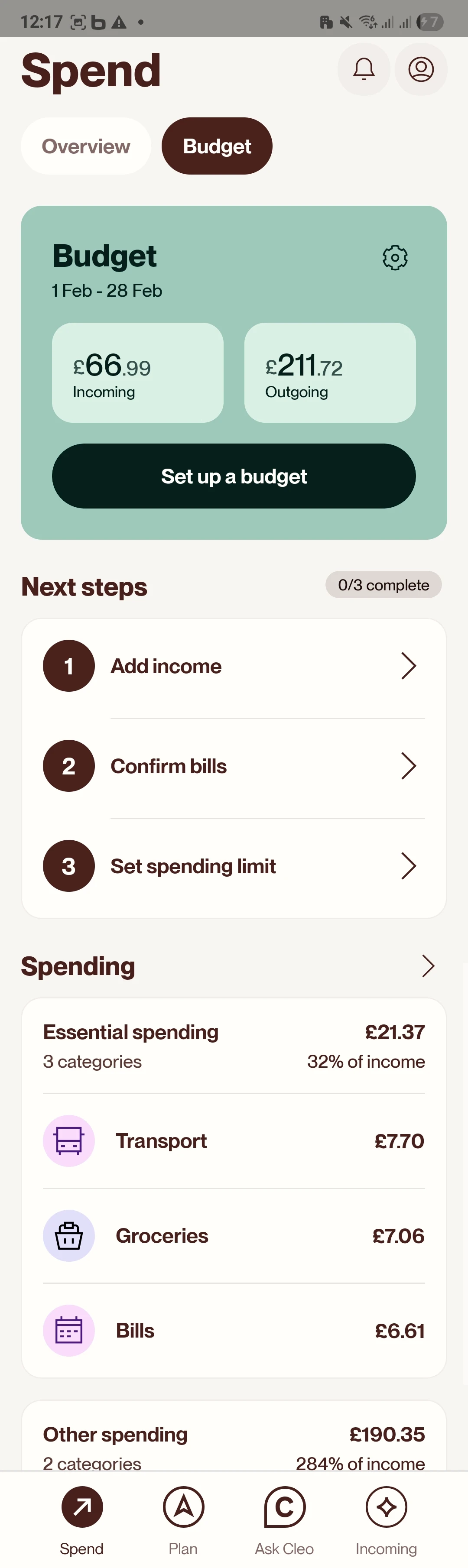

Key competitor reference: Cleo

Cleo is currently the most comparable mainstream finance app:

AI assistant with conversational insights

Everyday language over financial jargon

Habit-building nudges

However, Cleo is chat-first:

Conversation is the destination.

Moolo’s divergence: Forecast is the destination.

Moolo positions AI as support for decision-making, not the core product itself.

Benchmarking focused on tone, trust, and decision framing — not visual imitation.

Strategic Design Decisions

Forecast before coaching

Moolo surfaces financial direction first, not chat.

Users instantly see where they stand and where they’re heading.

Coaching as interpretation

AI translates numbers into decisions, not conversation.

Prompts are anchored in real life moments:

• Can I afford to eat out tonight?

• How am I doing this week?

• Where’s my money going?

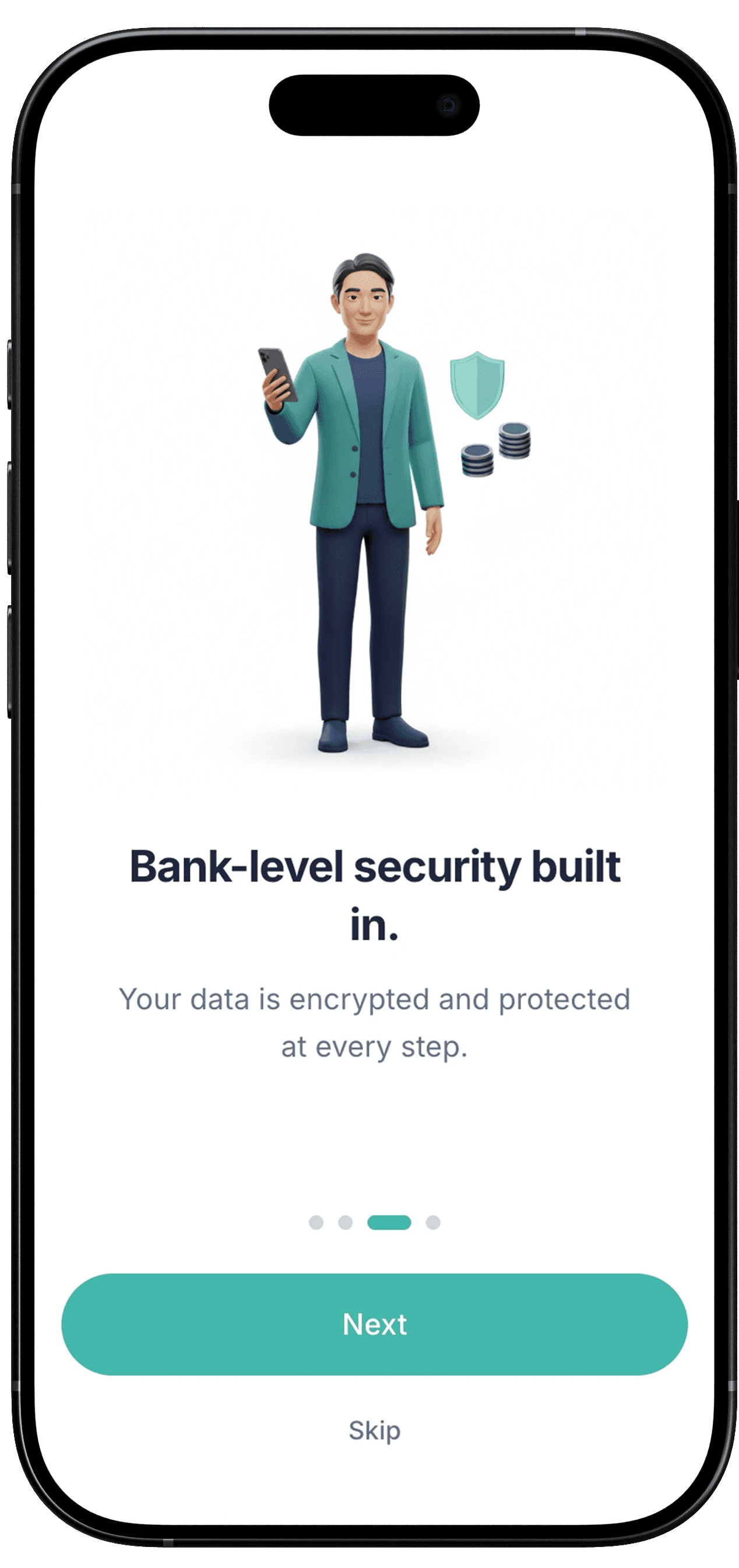

Trust over gimmicks

No gamification, red warnings, or panic notifications.

Tone is calm, readable, and transparent.

The system is designed to reduce anxiety — not increase engagement for its own sake.

User Journey Deep Dive

Mapping emotional states, mental models, and behavioral patterns across three critical user scenarios

User Journey Deep Dive

Mapping emotional states, mental models, and behavioral

patterns across three critical user scenarios

Experience Architecture

The core Moolo UX follows a nested loop:

Snapshot – where am I now?

Forecast – where am I heading?

Coaching interpretation – why and how do I change it?

Action simulation – what if I tweak variables?

Reinforcement – nudges that guide, not nag

This loop was intentionally designed to:

reduce anxiety

build comprehension

support agency

Each layer is a stage of understanding, not just a screen.

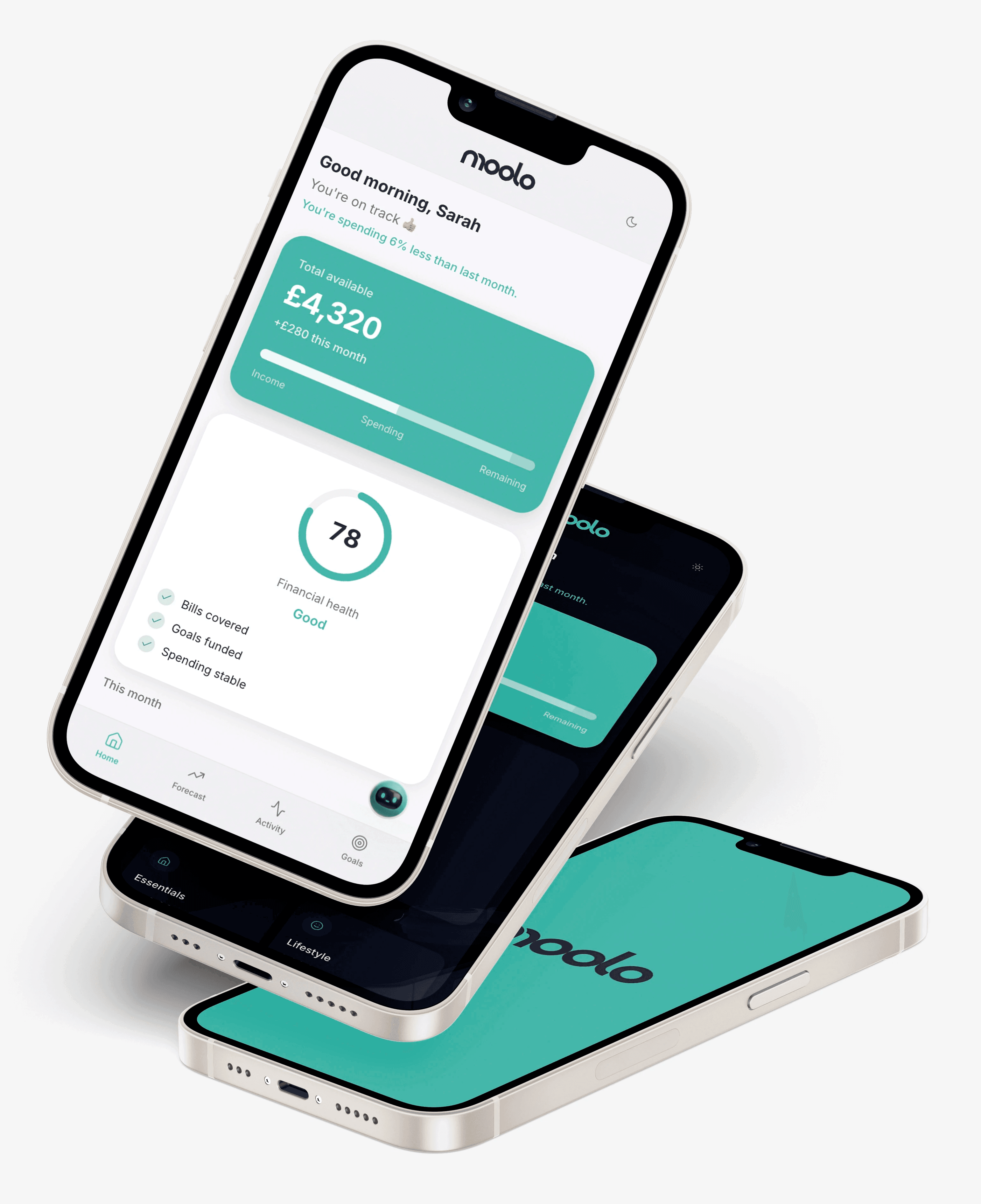

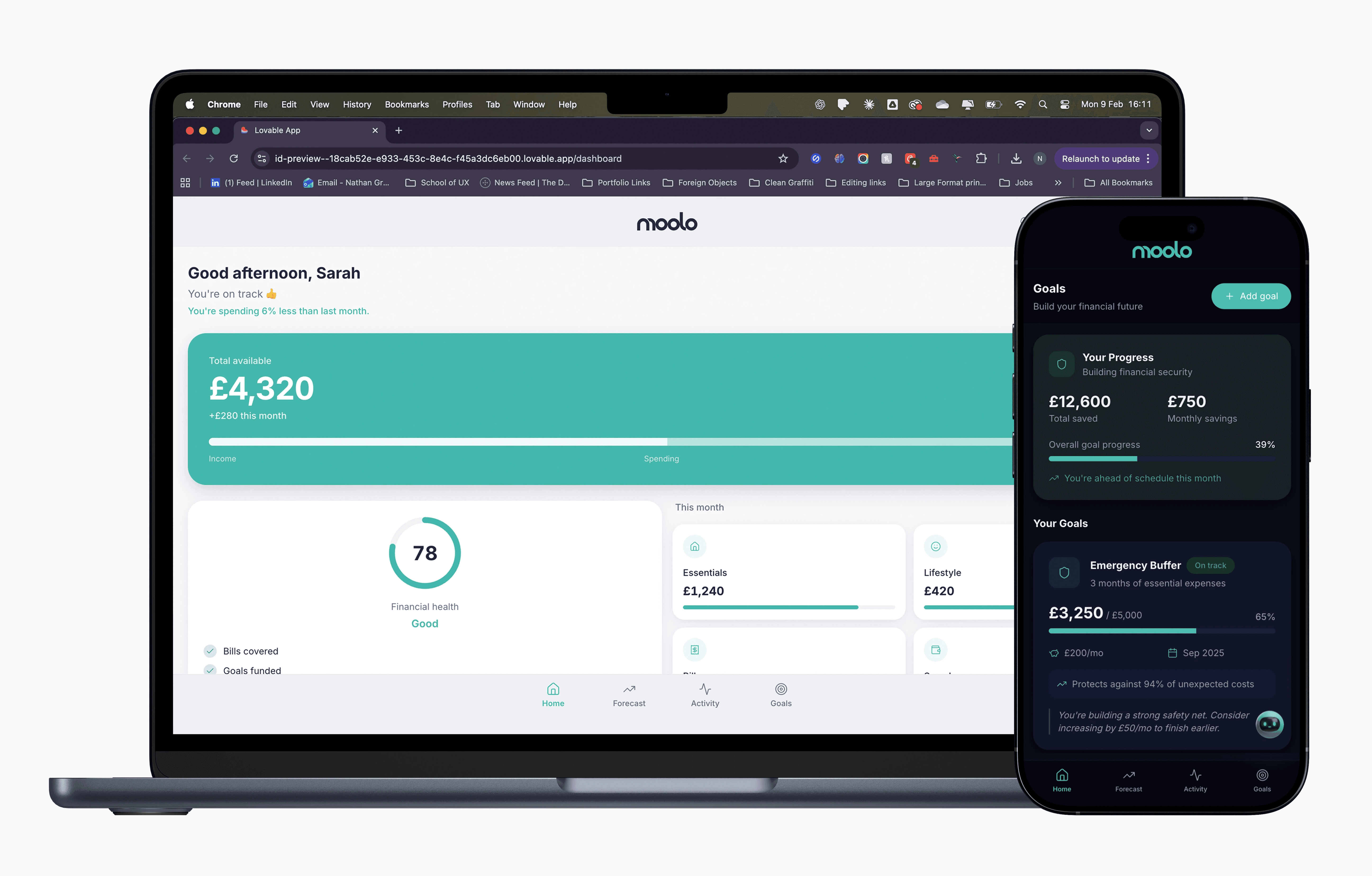

Screens and interaction highlights

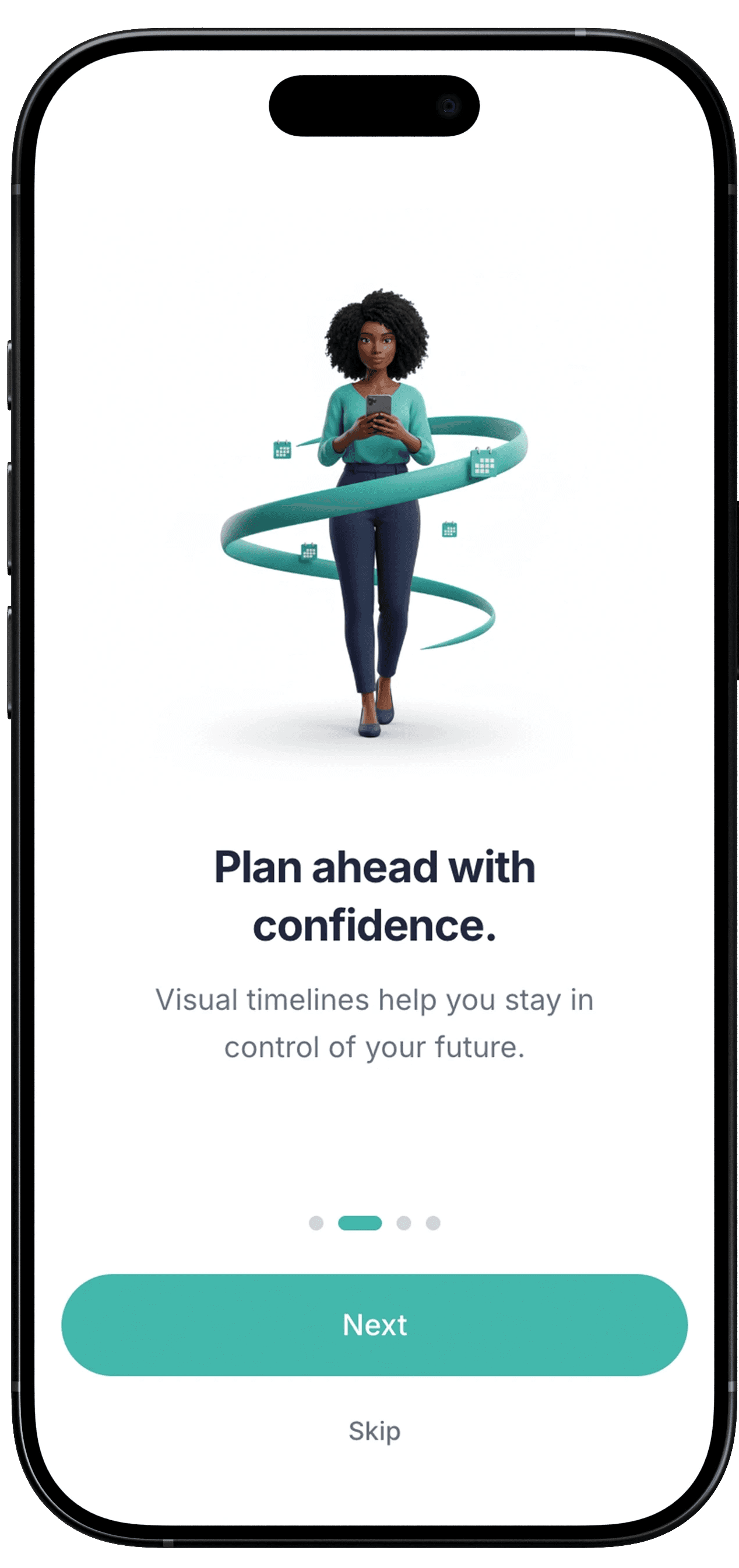

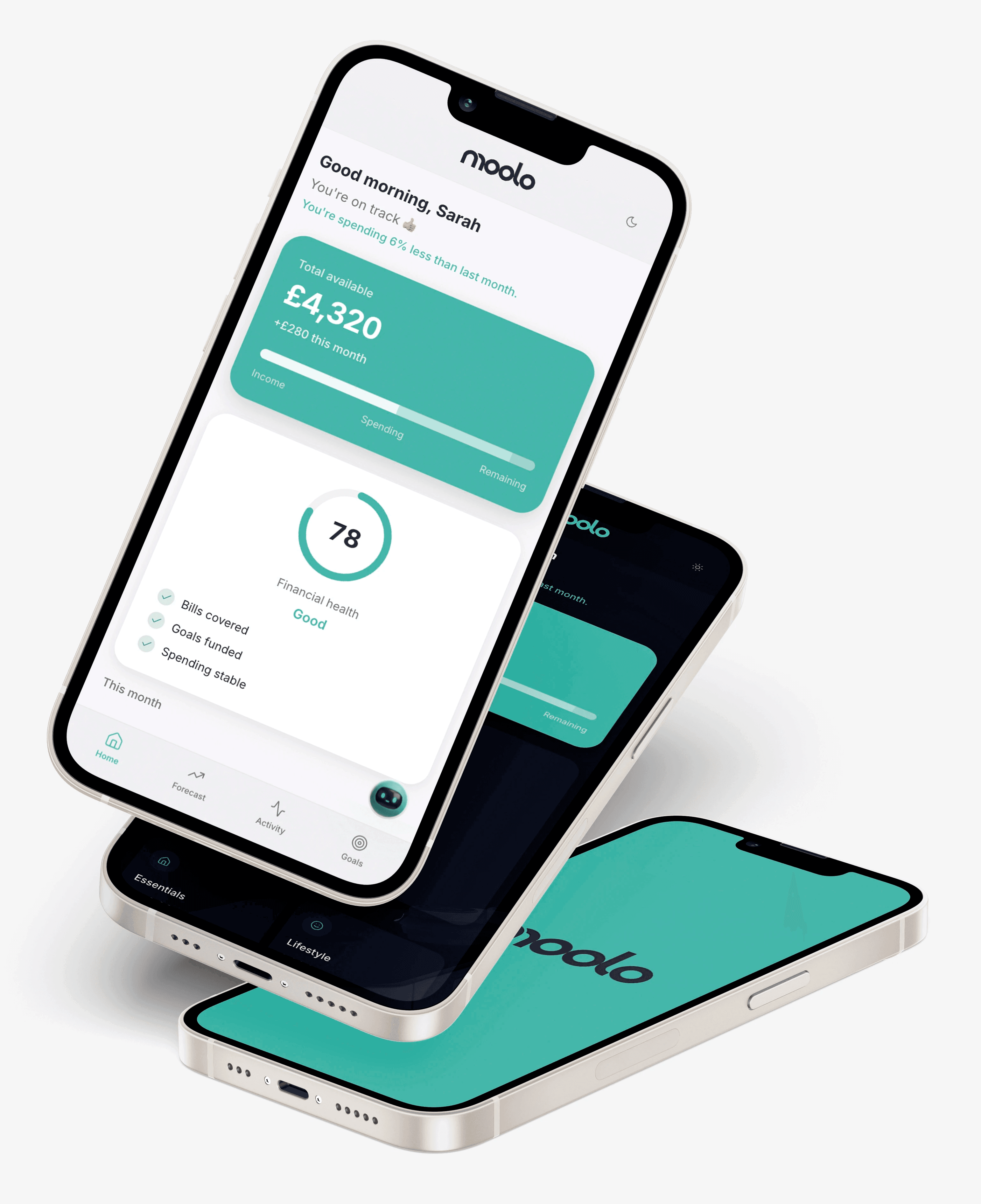

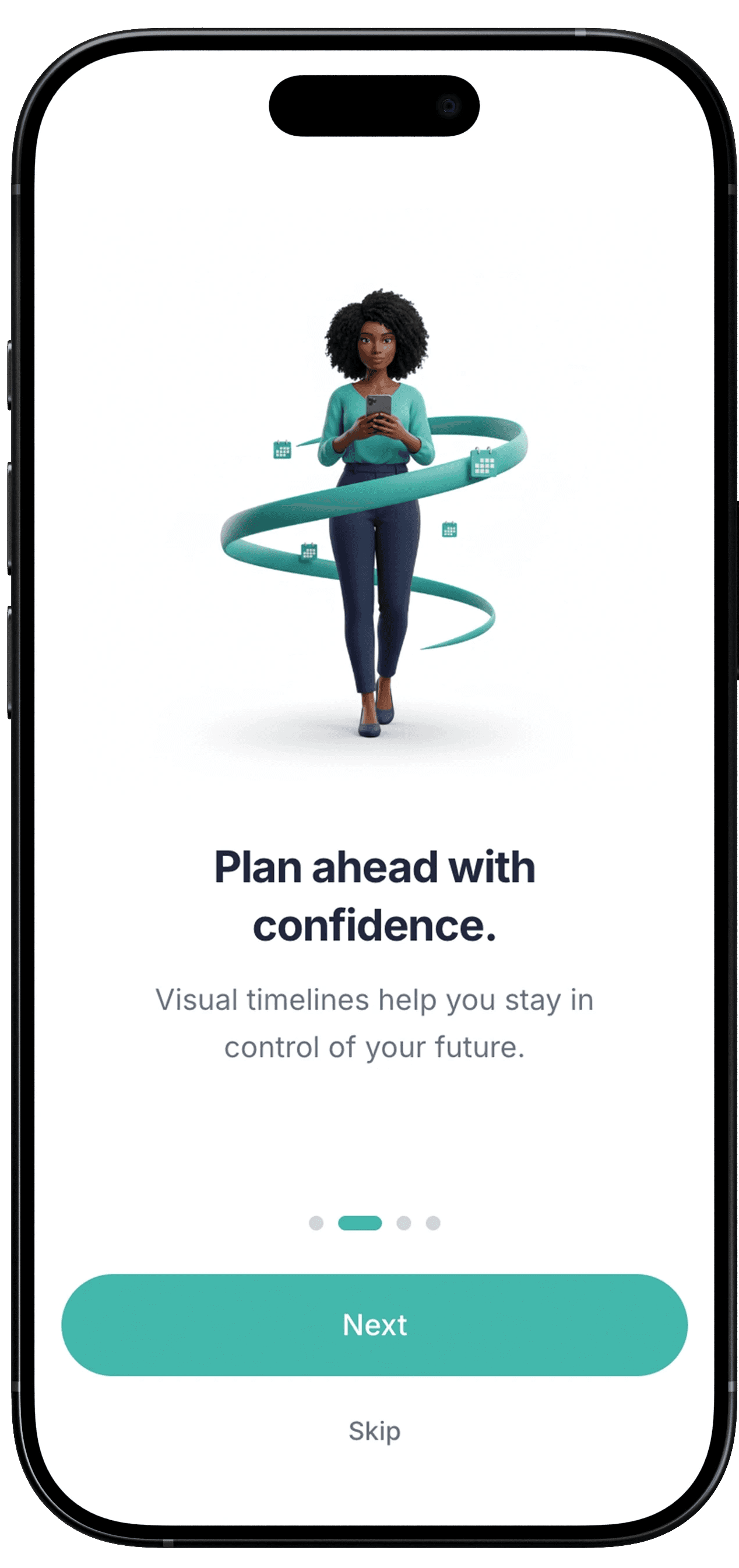

Onboarding

Introduces the product promise before any data:

Understanding money

Growth and goals

Safety in numbers

AI Copilot guidance

Illustrations use a consistent visual language to feel reassuring and professional — not gimmicky.

Onboarding builds emotional safety before data shows up.

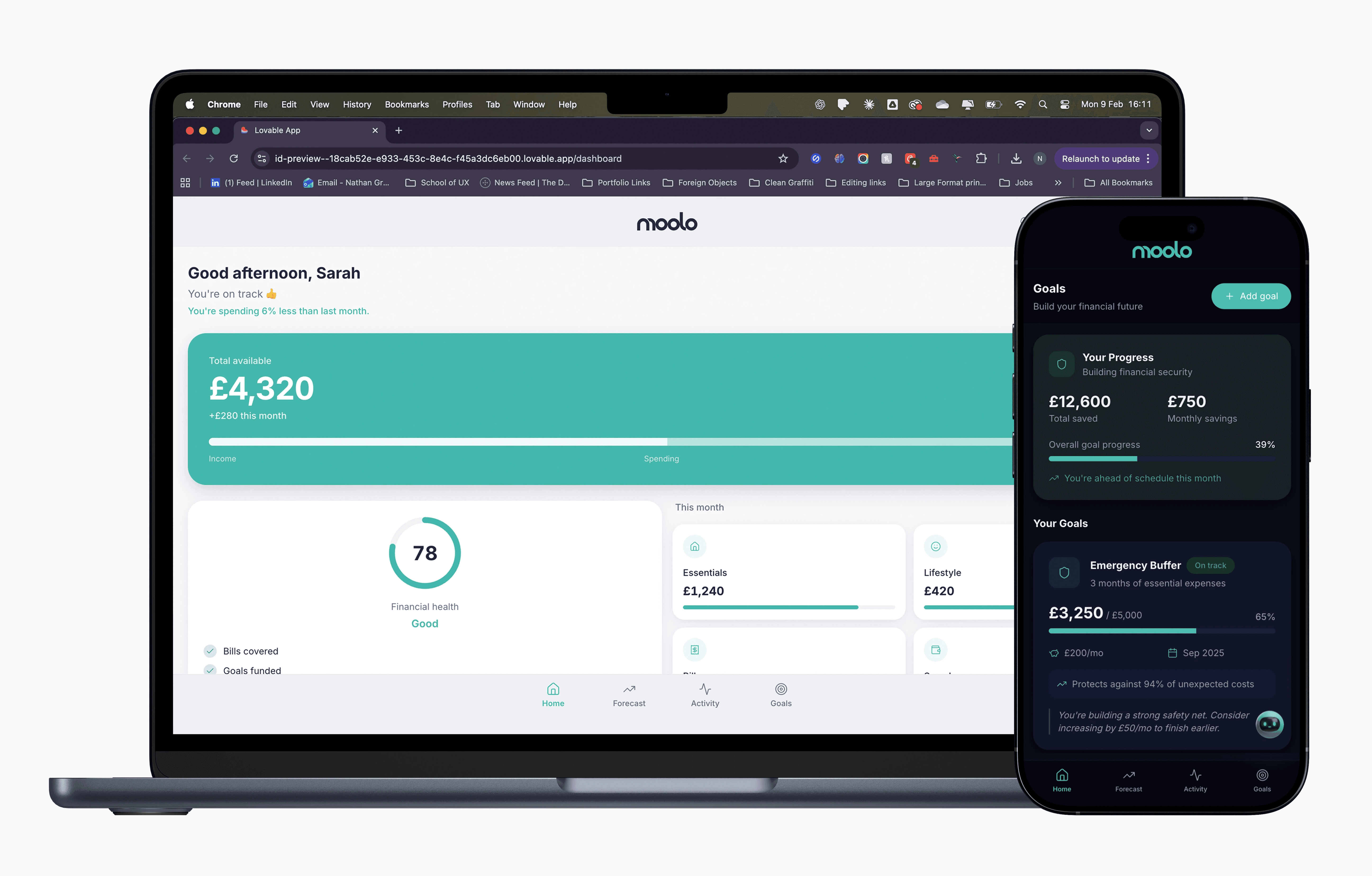

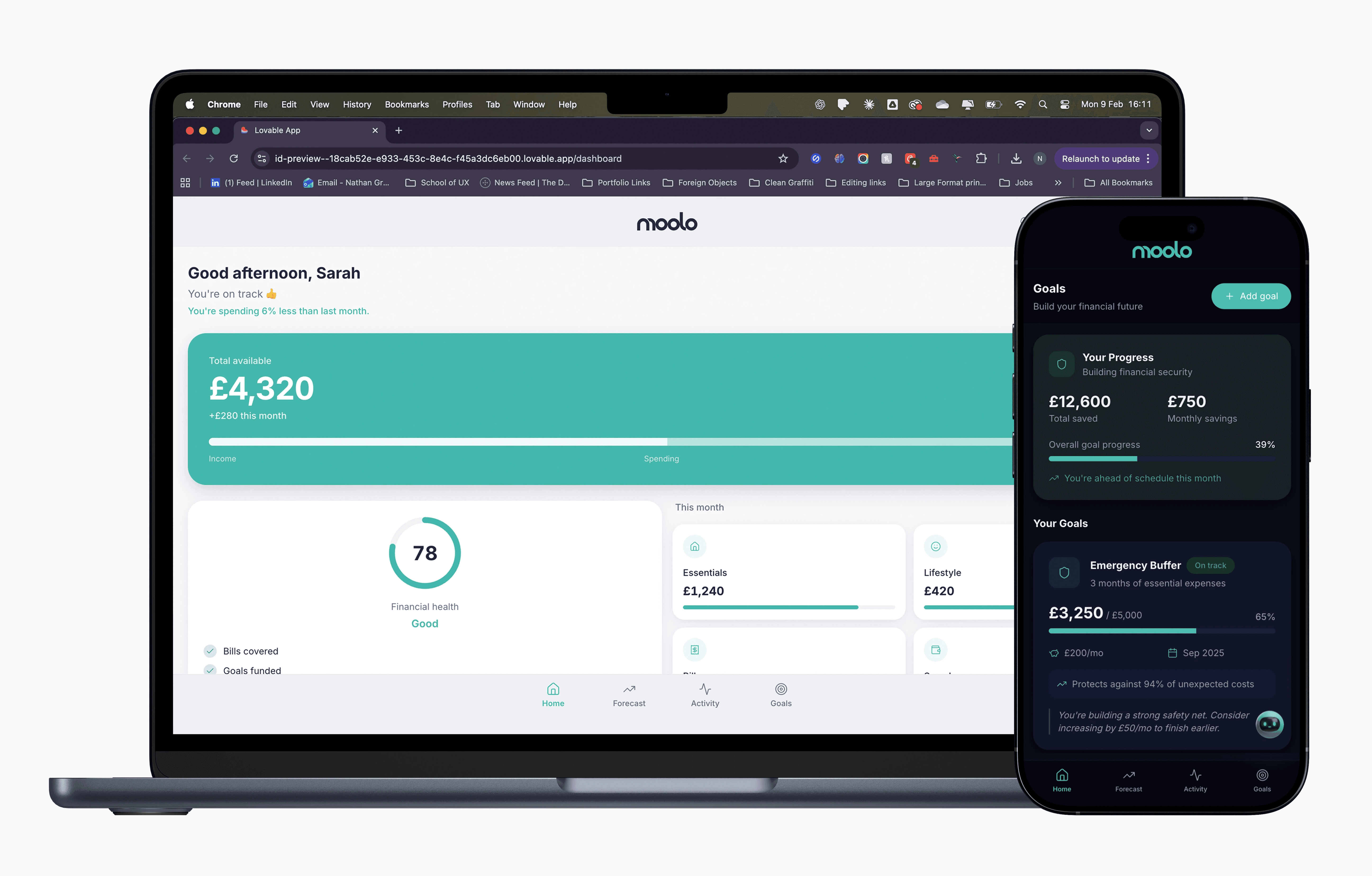

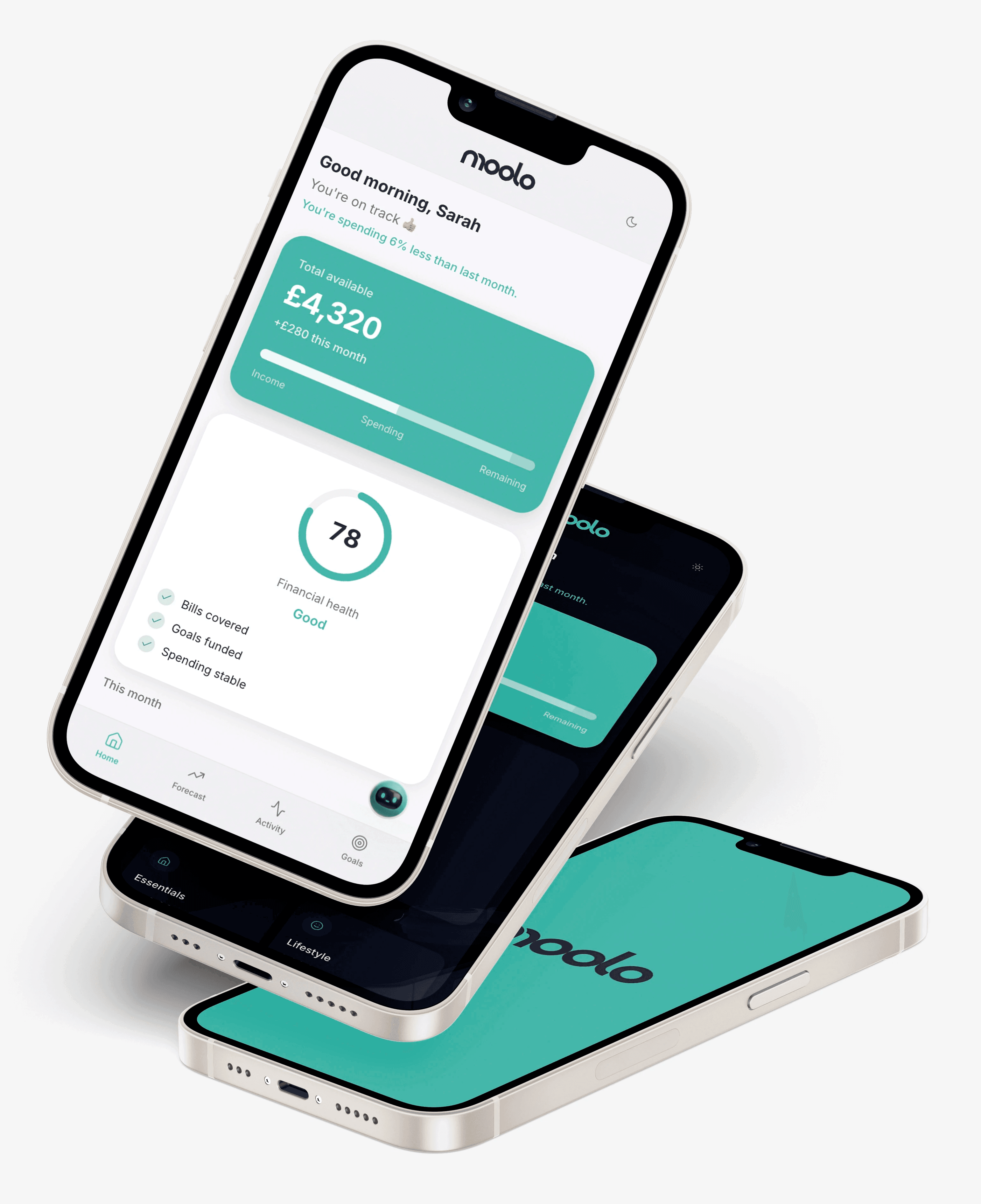

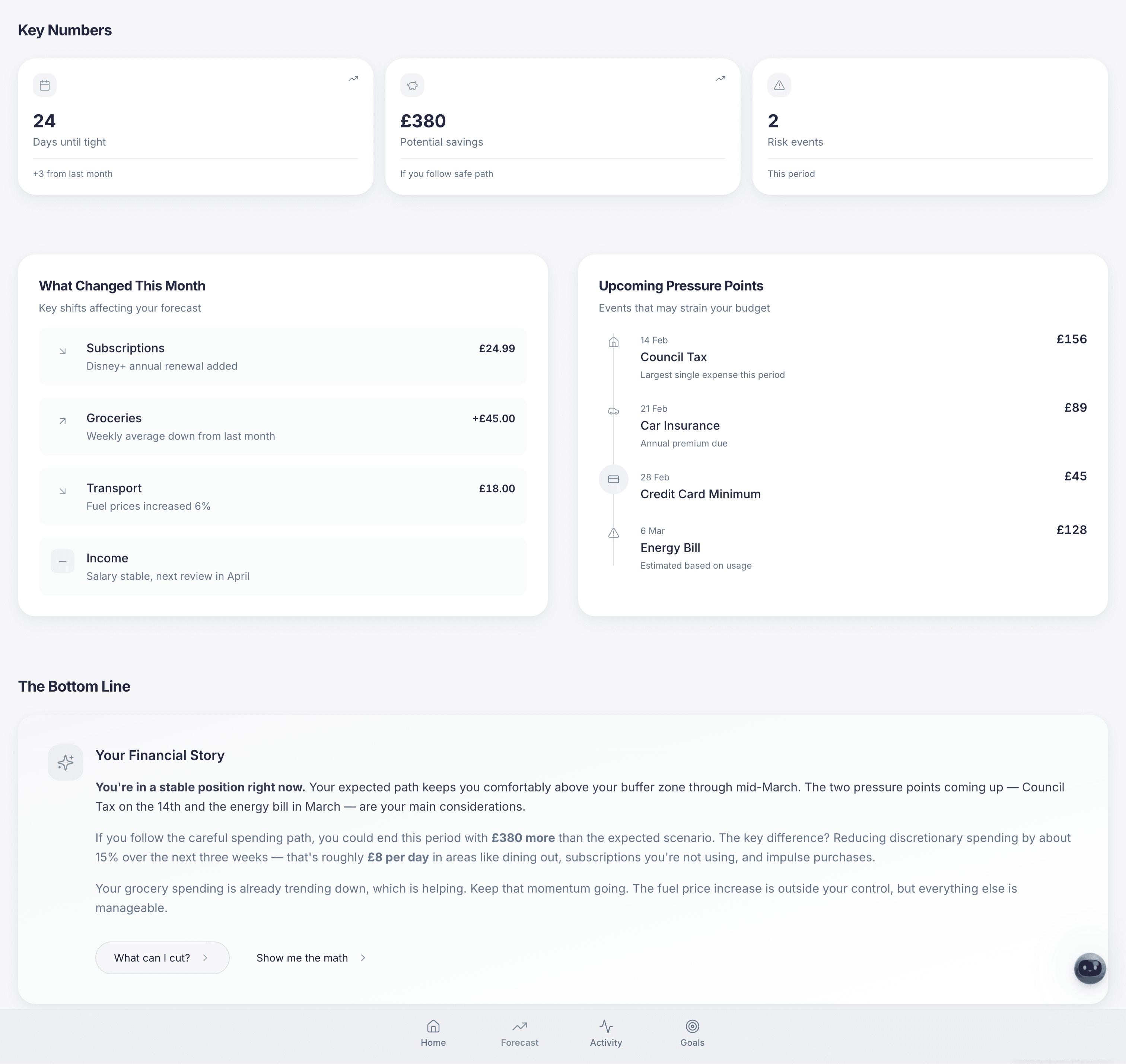

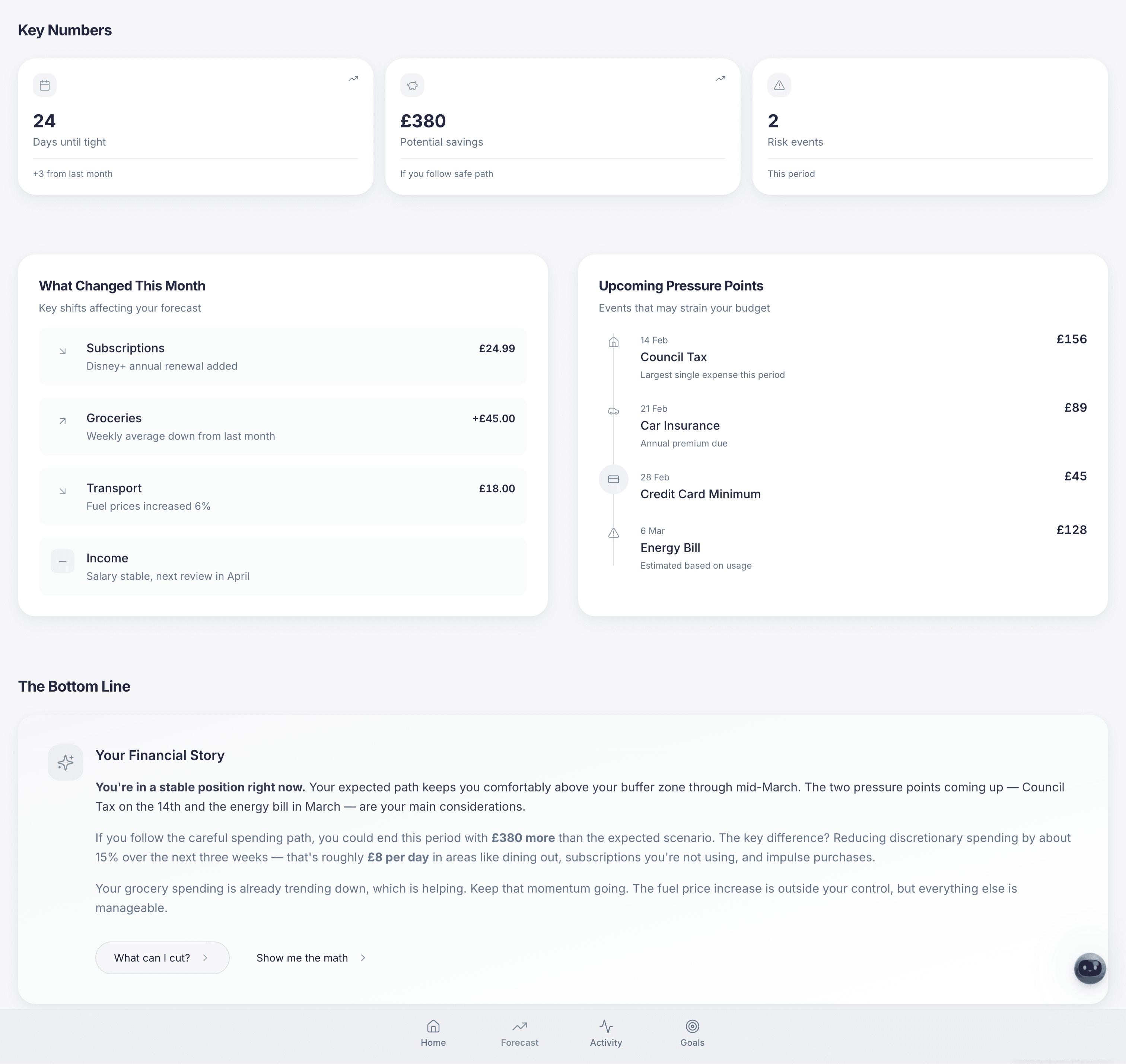

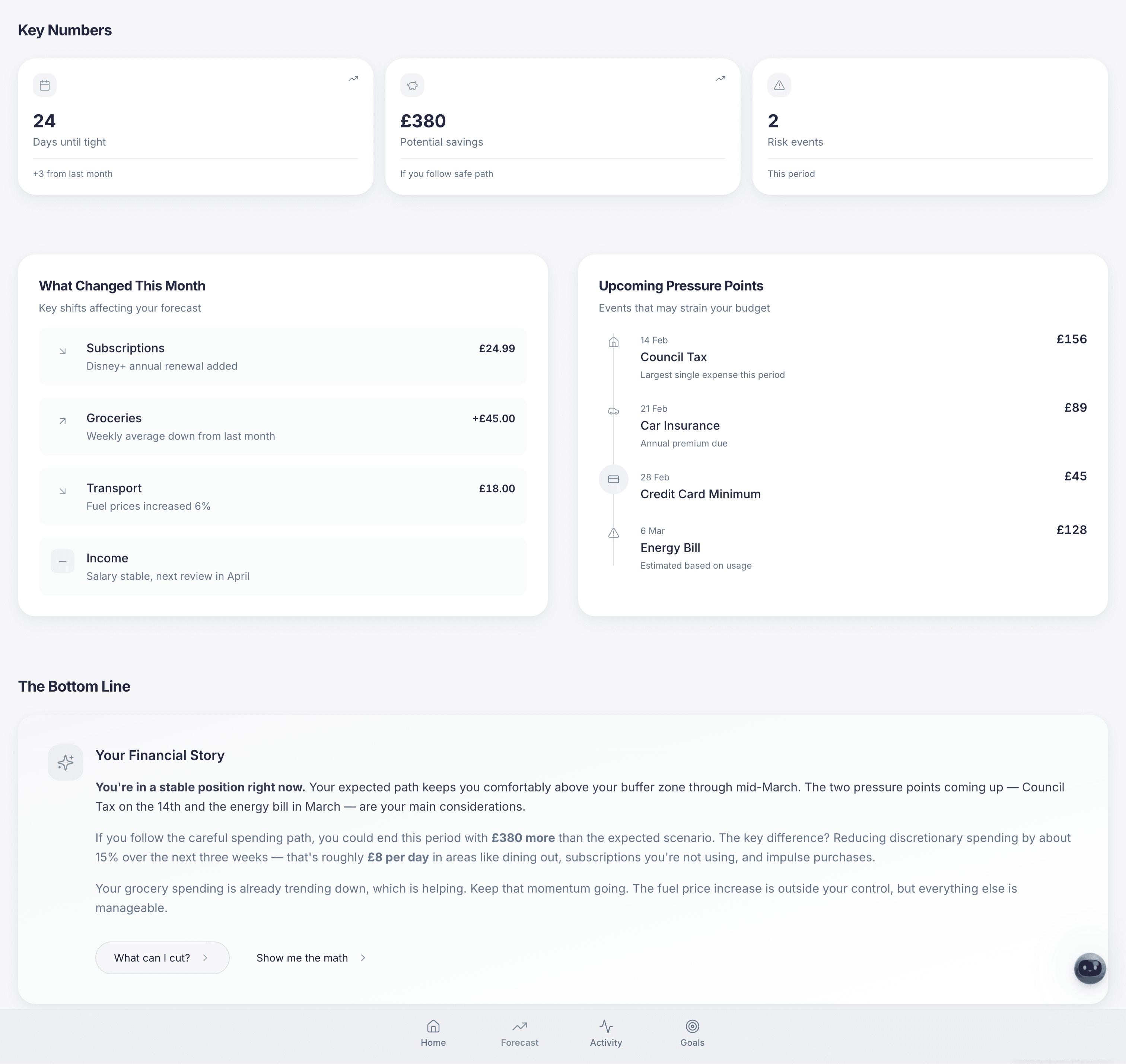

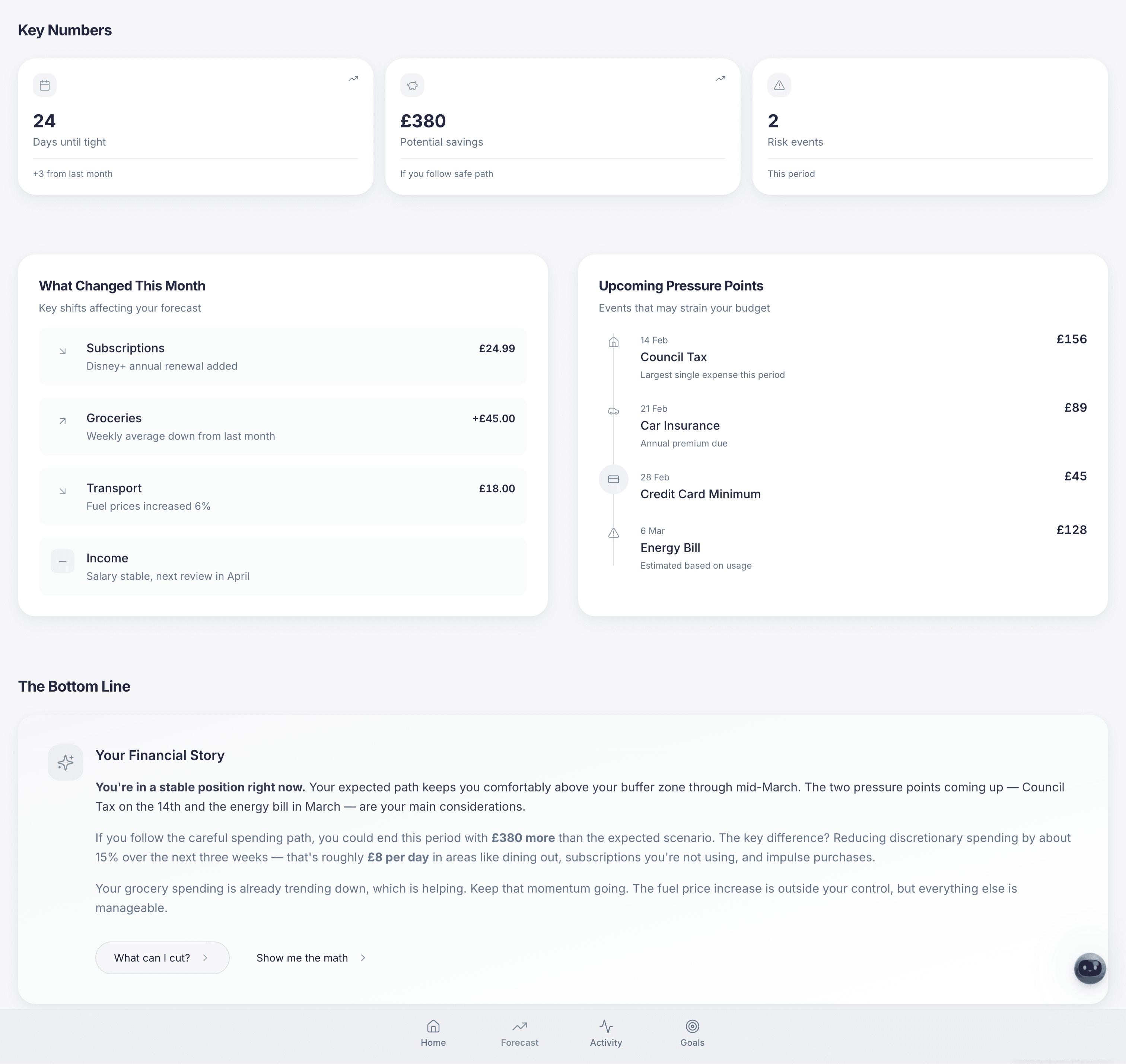

Forecast dashboard

Unlike traditional dashboards:

No line charts that feel like trading tools

Big “Total available” card

Narrative subtext

“Financial health” indicator

This answers “Am I okay?” fast.

Hero snapshot prioritises clarity over precision.

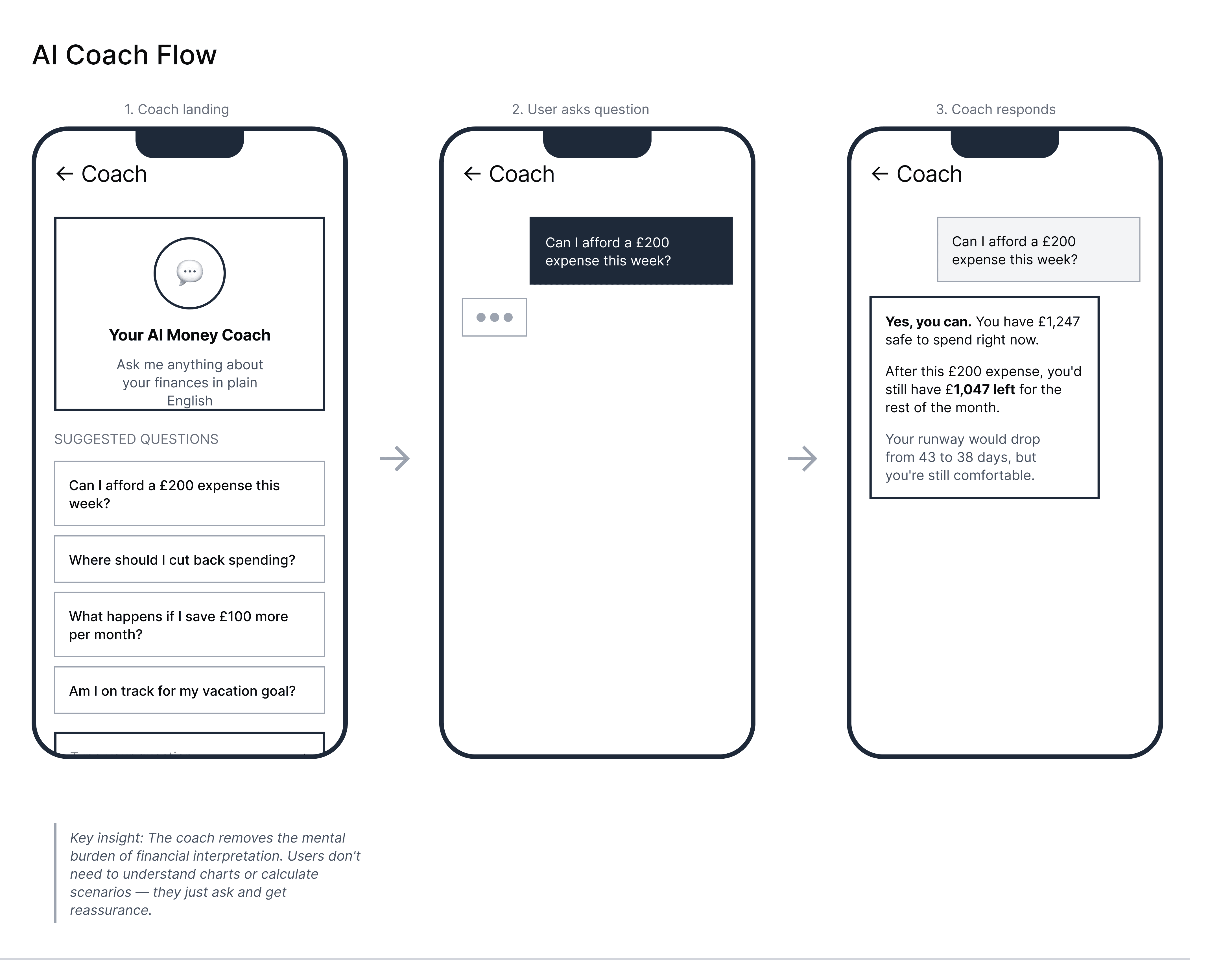

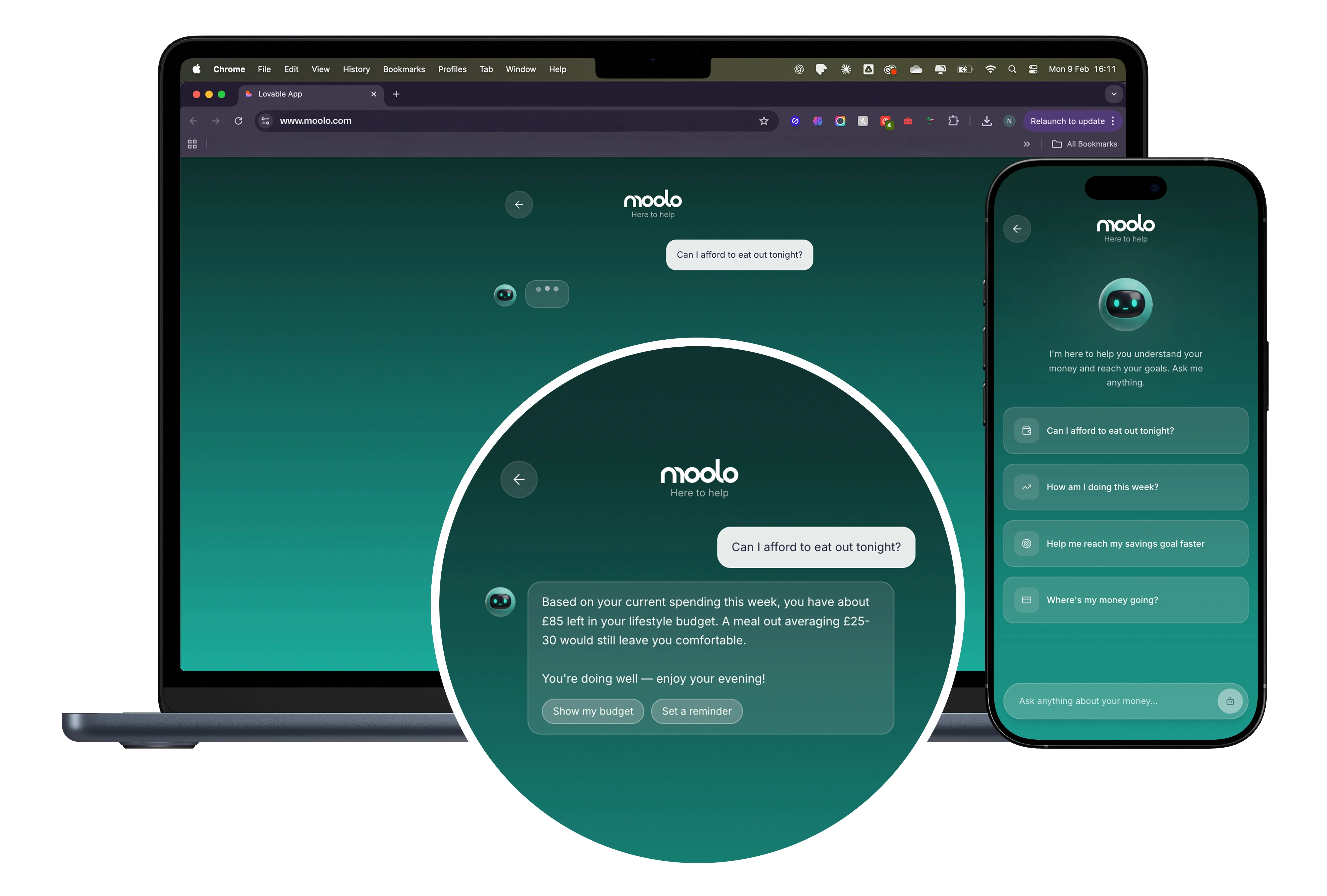

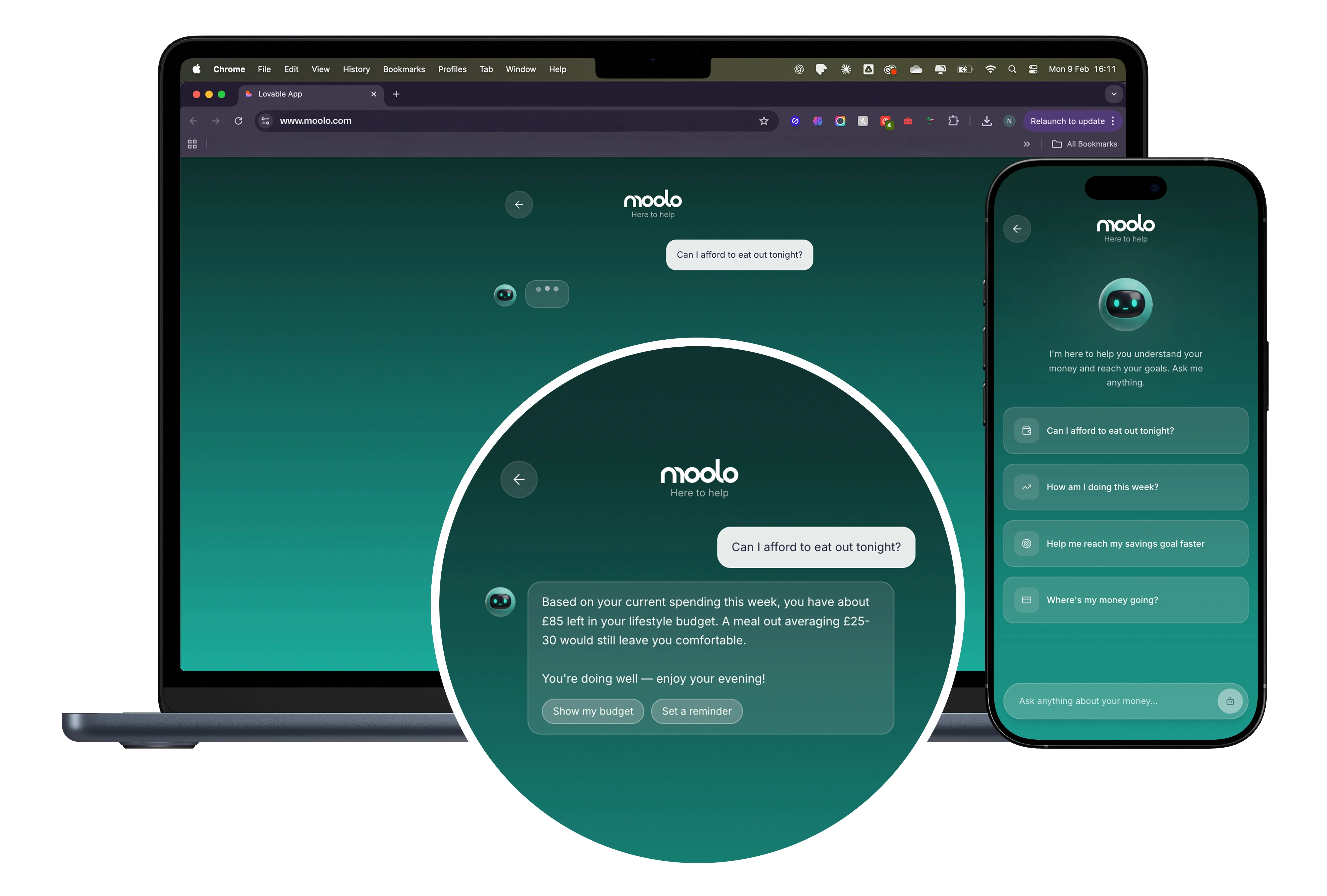

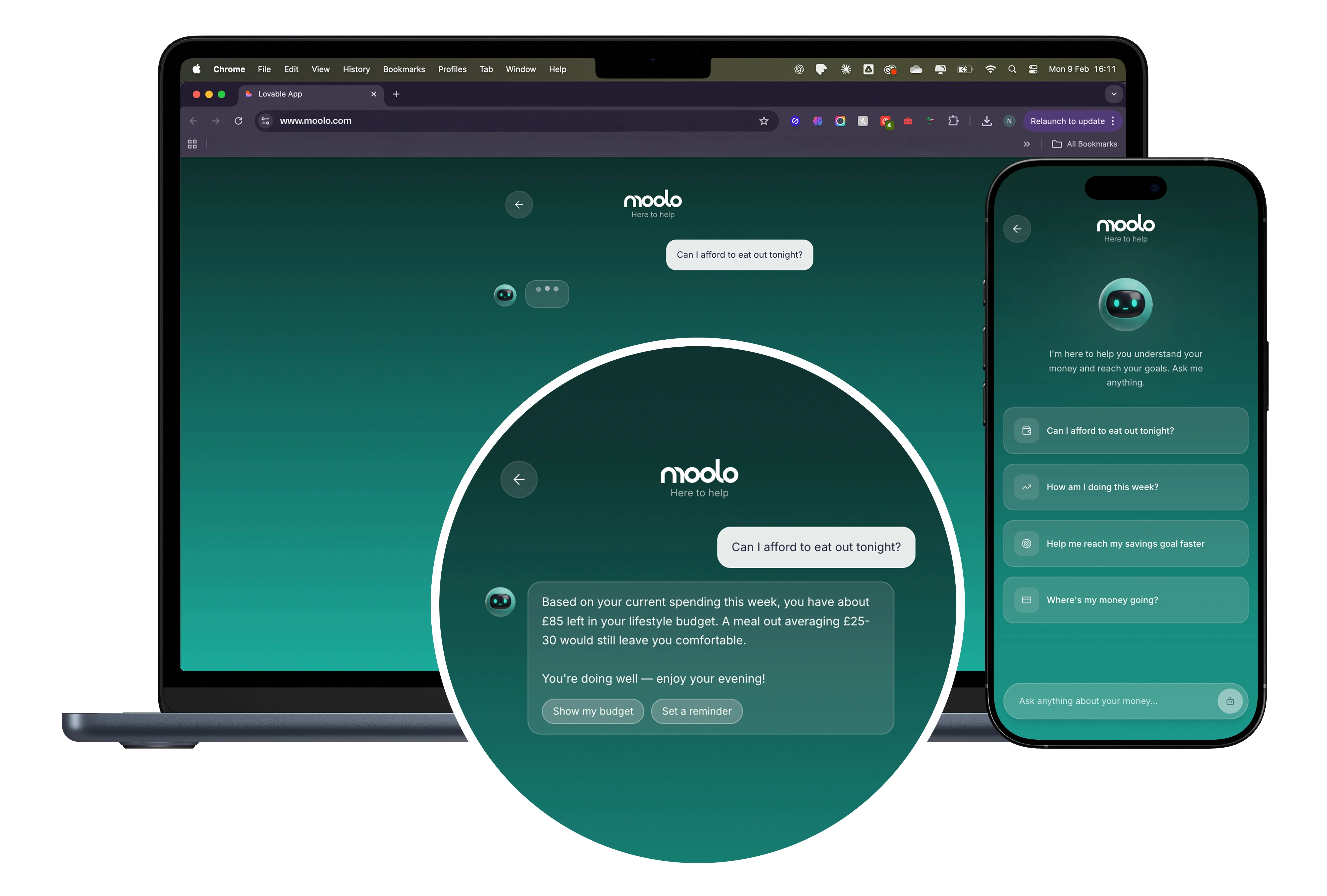

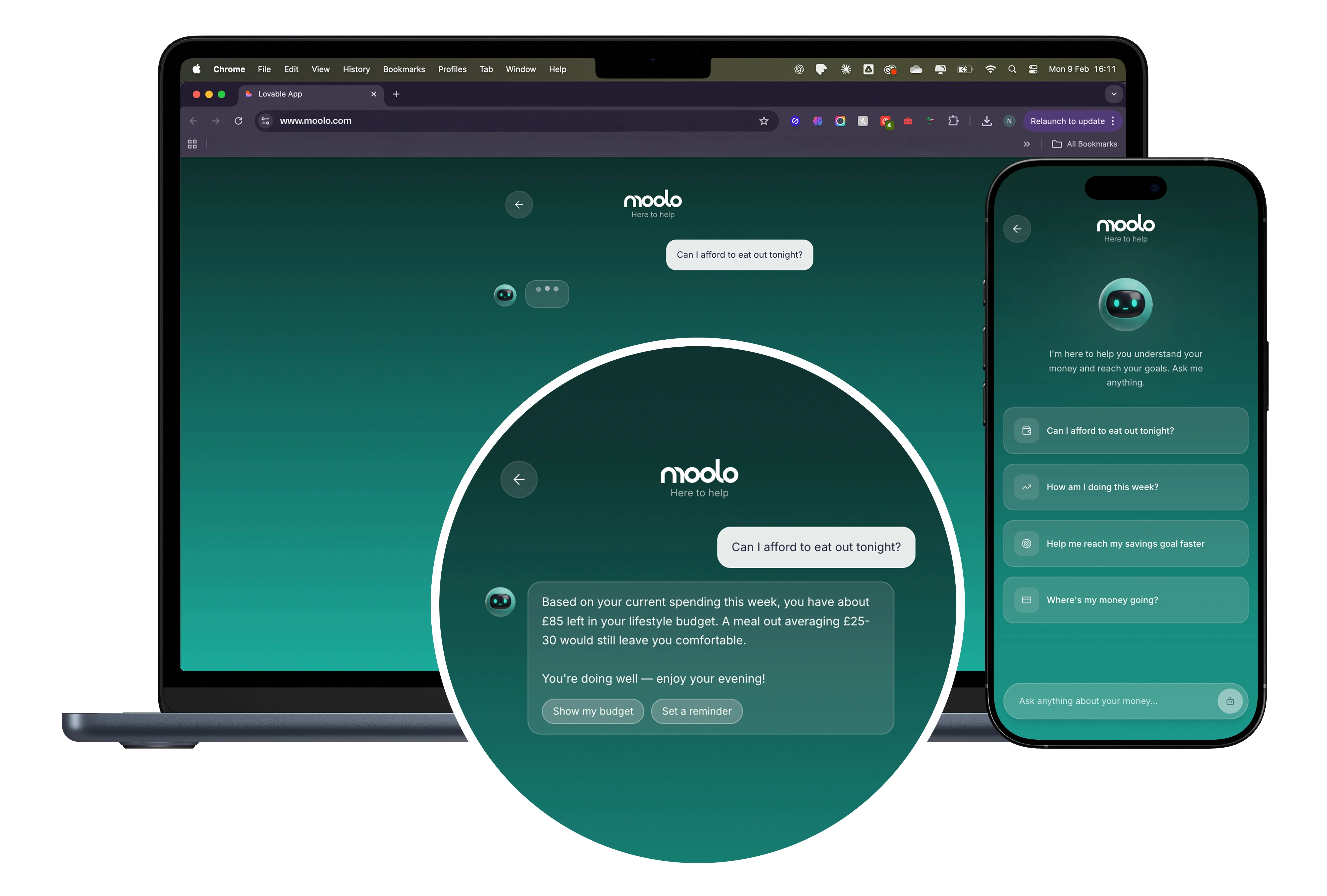

Smart Coaching

Moolo treats coaching as an interpretation layer, not a chatbot feature.

The goal isn’t conversation.

The goal is decision clarity.

Coaching sits between forecast and action — translating financial patterns into human guidance at the moment it matters.

Instead of generic alerts or gamified nudges, the system surfaces contextual prompts anchored to real decisions:

• Can I afford to eat out tonight?

• How am I doing this week?

• Help me reach my savings goal faster

• Where’s my money going?

These aren’t engagement hooks.

They’re cognitive shortcuts.

The assistant exists to reduce friction between data and behaviour — helping users move from awareness to action without overwhelm.

AI is infrastructure here, not the headline.

The experience is framed as coaching, because trust comes from clarity, not novelty.

Coaching delivers interpretation — content users want, not interruptions they ignore.

Challenges

& how I fixed them

Fragmented mindsets

Finance UX is often tools-first, not people-first.

Solution:

Reframe goals as directional confidence instead of budget lines.

Prediction vs Anxiety

Forecasting can make users anxious if visuals are intimidating.

Solution:

Friendly cards, simple progression, narrative text — not raw charts.

Design consistency

Component drift occurred as screens proliferated.

Solution:

A strict token system:

consistent spacing

iconography rules

grammar for motion

responsive layout logic

Outcome

Moolo re-imagines what personal finance feels like by:

✔ making foresight comprehensible

✔ reducing cognitive load early

✔ prioritising emotional safety

✔ positioning AI as assistance, not distraction

✔ building actionable guidance into the UI

This isn’t another dashboard — it’s a coaching product with structure, not just interface.

What i'd validate next

If moving toward a real product:

Ways to measure success

comprehension speed tests

coaching action adoption rates

forecast usefulness in decision moments

emotional comfort metrics

What I would refine

calibration of suggested prompts

personalised triggers

adaptive tutorial flow

long-term habit progression

This shows the prototype is not the final product — it’s a testable, learnable system.

More Projects

(01)

(UX/UI Moolo Personal Finance Assistant)

© 2026

(01)

(UX/UI Moolo Personal Finance Assistant)

© 2026

Project overview

Role: Lead Product Designer — UX strategy, product framing, interaction design, research, prototyping. Brand Designer

( Logo + Illustrations)

Timeline: 4 weeks

Platform: Web and Mobile app

Tools: Figma, Lovable, Firefly (illustrations), Illustrator (Logo Creation)

Project type: Fintech personal finance tool

Background & brief

Moolo is a concept designed around a core insight:

People don’t avoid finance because they lack data — they avoid it because they don’t understand the meaning of that data.

Most personal finance tools focus on reporting.

Moolo focuses on interpretation — answering:

“Am I okay?”

“What happens next?”

“What should I do?”

A benign dashboard does not solve financial anxiety.

A forecast-first guided experience does.

Problem

Problem

Traditional finance tools overwhelm users with:

dense charts

financial jargon

spreadsheets disguised as dashboards

These patterns make people feel:

unsure

confused

judged

intimidated

The core challenge became:

How do we design a product that explains the future, not just what happened?

Dense dashboards prioritise data density over decision clarity.

Research &

Benchmarking

I evaluated how existing products handle financial explanations, focusing on:

Goals of benchmarking

How do products communicate financial health?

Where do users feel confident vs overwhelmed?

What interaction models support ongoing behaviour change?

Key competitor reference: Cleo

Cleo is currently the most comparable mainstream finance app:

AI assistant with conversational insights

Everyday language over financial jargon

Habit-building nudges

However, Cleo is chat-first:

Conversation is the destination.

Moolo’s divergence: Forecast is the destination.

Moolo positions AI as support for decision-making, not the core product itself.

Benchmarking focused on tone, trust, and decision framing — not visual imitation.

Strategic Design

Decisions

Forecast before coaching

Moolo surfaces financial direction first, not chat.

Users instantly see where they stand and where they’re heading.

Coaching as interpretation

AI translates numbers into decisions, not conversation.

Prompts are anchored in real life moments:

• Can I afford to eat out tonight?

• How am I doing this week?

• Where’s my money going?

Trust over gimmicks

No gamification, red warnings, or panic notifications.

Tone is calm, readable, and transparent.

The system is designed to reduce anxiety — not increase engagement for its own sake.

User Journey Deep Dive

Mapping emotional states, mental models, and behavioural patterns across three critical user scenarios

Experience

Architecture

The core Moolo UX follows a nested loop:

Snapshot – where am I now?

Forecast – where am I heading?

Coaching interpretation – why and how do I change it?

Action simulation – what if I tweak variables?

Reinforcement – nudges that guide, not nag

This loop was intentionally designed to:

reduce anxiety

build comprehension

support agency

Each layer is a stage of understanding, not just a screen.

Screens and

interaction highlights

Onboarding

Introduces the product promise before any data:

Understanding money

Growth and goals

Safety in numbers

AI Copilot guidance

Illustrations use a consistent visual language to feel reassuring and professional — not gimmicky.

Onboarding builds emotional safety before data shows up.

Forecast dashboard

Unlike traditional dashboards:

No line charts that feel like trading tools

Big “Total available” card

Narrative subtext

“Financial health” indicator

This answers “Am I okay?” fast.

Hero snapshot prioritises clarity over precision.

Smart Coaching

Moolo treats coaching as an interpretation layer, not a chatbot feature.

The goal isn’t conversation.

The goal is decision clarity.

Coaching sits between forecast and action — translating financial patterns into human guidance at the moment it matters.

Instead of generic alerts or gamified nudges, the system surfaces contextual prompts anchored to real decisions:

• Can I afford to eat out tonight?

• How am I doing this week?

• Help me reach my savings goal faster

• Where’s my money going?

These aren’t engagement hooks.

They’re cognitive shortcuts.

The assistant exists to reduce friction between data and behaviour — helping users move from awareness to action without overwhelm.

AI is infrastructure here, not the headline.

The experience is framed as coaching, because trust comes from clarity, not novelty.

Coaching delivers interpretation — content users want, not interruptions they ignore.

More Projects

Challenges

& how I fixed them

Fragmented mindsets

Finance UX is often tools-first, not people-first.

Solution:

Reframe goals as directional confidence instead of budget lines.

Prediction vs Anxiety

Forecasting can make users anxious if visuals are intimidating.

Solution:

Friendly cards, simple progression, narrative text — not raw charts.

Design consistency

Component drift occurred as screens proliferated.

Solution:

A strict token system:

consistent spacing

iconography rules

grammar for motion

responsive layout logic

Outcome

Moolo re-imagines what personal finance feels like by:

✔ making foresight comprehensible

✔ reducing cognitive load early

✔ prioritising emotional safety

✔ positioning AI as assistance, not distraction

✔ building actionable guidance into the UI

This isn’t another dashboard — it’s a coaching product with structure, not just interface.

What i'd validate next

If moving toward a real product:

Ways to measure success

comprehension speed tests

coaching action adoption rates

forecast usefulness in decision moments

emotional comfort metrics

What I would refine

calibration of suggested prompts

personalised triggers

adaptive tutorial flow

long-term habit progression

This shows the prototype is not the final product — it’s a testable, learnable system.